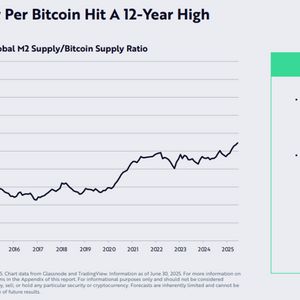

Payment giants Visa and Mastercard are reportedly gearing up to fend off a quarter-trillion-dollar threat against their business models. Bloomberg reports that executives at the two companies – which are a combined $1.1 trillion in market capitalization – are preparing for the continued rise of stablecoins, which drastically lower the cost of everyday transactions for both giants’ customers. Jack Forestell, chief product and strategy officer at Visa, says that in prior disruptions, such as mobile wallets and buy-now-pay-later apps, corporate adaptation ultimately prevailed. “We’ve been tokenizing access to value for a very long time now… Now the value that underlies that token, by and large, is either bank accounts or credit lines, debit and credit cards, but there’s absolutely no reason that can’t be a stablecoin or another cryptocurrency… When you’re crypto natives, you can send money back and forth, but if you want to use that in a broad scale manner for your everyday purposes, you need that hyperscale connectivity, and we provide the best onramp to that.” And Jorn Lambert, chief product officer at Mastercard, says that the rise of stablecoins more so represents new “opportunities” rather than a threat of replacement. “We shouldn’t assume that overnight, stablecoins will replace existing card payments or fiat… We think this is much more about new use cases and new opportunities than about replacing the existing system, especially in remittances, disbursements and business-to-business payments.” According to data from CoinGecko, the current market cap of all stablecoins in circulation is over $255 billion. According to last month’s report from The Wall Street Journal, anonymous people familiar with the matter said that some of the world’s largest retailers are considering issuing their very own dollar-pegged crypto assets in the US in an effort to save billions of dollars in transaction fees. Walmart, Amazon, Expedia and unnamed airline companies were among those listed in the WSJ report. Follow us on X , Facebook and Telegram Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox Check Price Action Surf The Daily Hodl Mix Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing. Generated Image: Midjourney The post Here’s the $255,000,000,000 Threat That Visa and Mastercard Are Facing Right Now, According to Insiders: Report appeared first on The Daily Hodl .