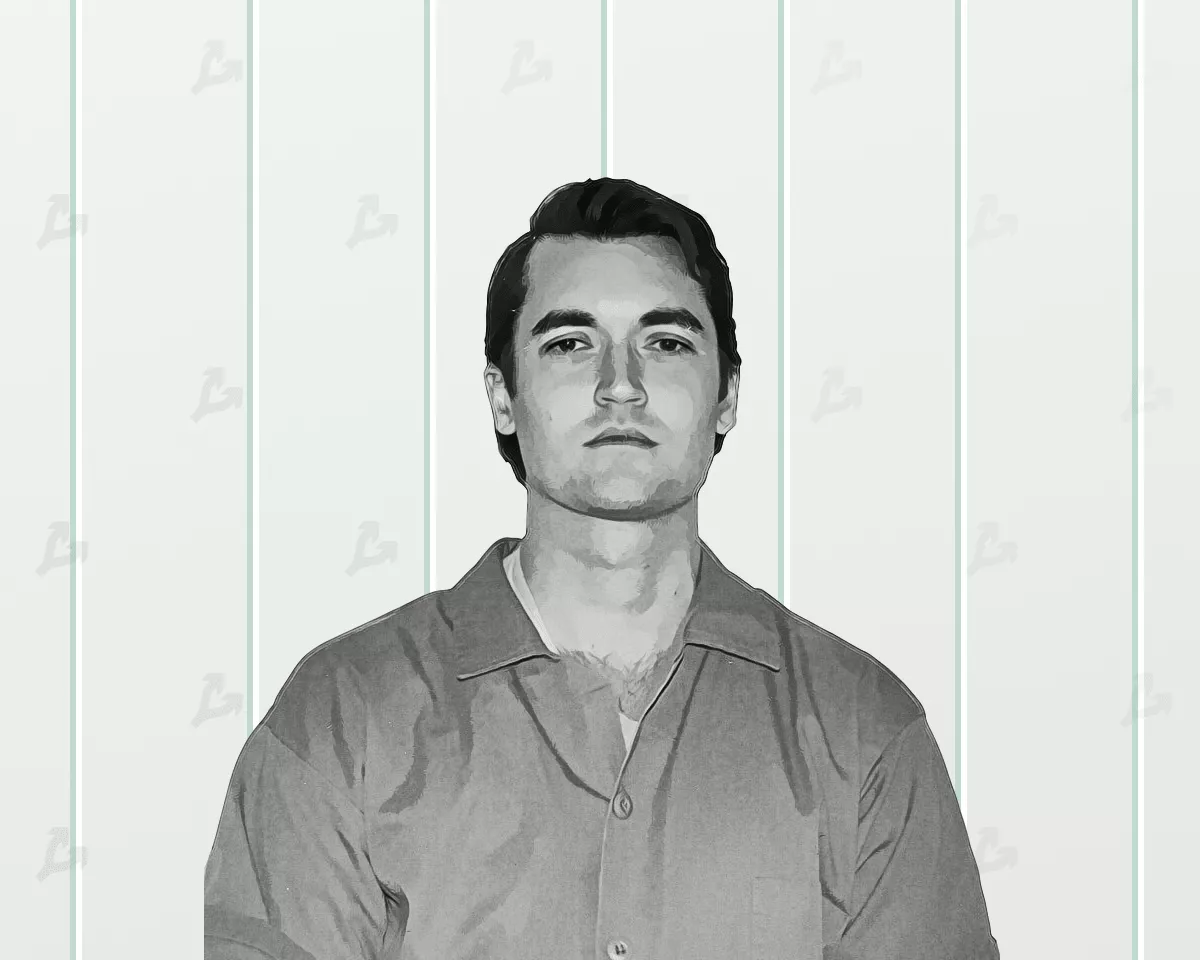

Video streaming platform and YouTube competitor Rumble has officially entered the crypto space. The company’s CEO confirmed that Rumble has made its first Bitcoin (BTC) purchase and hinted that this will not be the last. Rumble CEO Confirms Bitcoin Purchase In a post shared on X earlier today, Rumble CEO Chris Pavlovski announced that the video streaming platform made its first BTC purchase on January 17. Pavlovski further stated that this purchase “won’t be the last,” suggesting the company may increase its Bitcoin holdings in the coming months. Pavlovski, however, did not disclose the exact amount of BTC purchased. Nonetheless, Rumble’s move underscores the growing trend of corporations adding BTC to their balance sheets. It’s worth noting that Rumble’s CEO first hinted at a corporate crypto purchase in November 2024, when he conducted a poll on X asking users whether Rumble should add BTC to its balance sheet. Over 39,000 people participated in the poll, with an overwhelming majority voting in favor of the move. Renowned Bitcoin advocate and MicroStrategy CEO Michael Saylor even responded, offering to discuss “why and how” Bitcoin could be a strategic asset for Rumble. Subsequently, in December 2024, Rumble unveiled a Bitcoin treasury strategy as it set aside $20 million to purchase the leading digital asset. At the time, Pavlovski described Bitcoin as a “valuable tool for strategic planning.” Interestingly, Rumble’s stock (RUM) closed 5.31% higher at the end of trading on Friday. Although the stock market is closed today in observance of Martin Luther King Jr. Day, RUM could see further gains when trading resumes tomorrow. BTC Adoption To Grow Exponentially In 2025? Bitcoin saw unprecedented adoption in 2024, with milestones such as the US Securities and Exchange Commission (SEC) approving spot BTC exchange-traded funds (ETFs) and an increasing number of companies incorporating Bitcoin into their treasury strategies. However, 2025 promises to bring even greater adoption. The election of pro-crypto Republican candidate Donald Trump as US president has fueled speculation about the creation of a US Bitcoin strategic reserve. If implemented , such a reserve could become the most significant catalyst to date for cementing Bitcoin’s status as a reliable and trusted store of value. A recent report by Fidelity Digital Assets outlines rising nation-state and government adoption of BTC as the major factors that may drive the cryptocurrency’s growth in 2025. Similarly, Standard Chartered predicts that BTC can reach as high as $200,000 by the end of 2025, buoyed by favourable crypto regulations under Trump’s presidency. That said, changes in global macroeconomic policies could pose a danger to BTC’s bullish momentum. At press time, BTC trades at $107,608, up 1.6% in the past 24 hours.