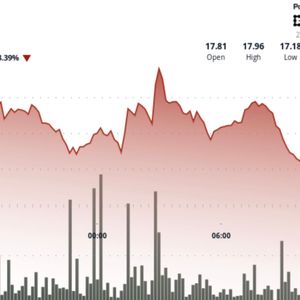

Even with the recent downturn in prices, Arbitrum is generating quite a bit of excitement in the decentralized finance space. Just last week, the protocols built on Arbitrum collectively produced $1.43 million in income, a jump of 23% from the week before. To have something grow like that when most other projects are sitting still or going backward is starting to catch some attention and is even raising some eyebrows. Is Arbitrum something that you should be paying more attention to and maybe doing a little bit more with? Protocol Performance Is Picking Up Steam At the pinnacle of the revenue charts on Arbitrum was GMX, the already-famous perpetual trading platform, which pulled in $550,000 in revenue over the last week. Closely tailing it was Ostium Labs, which generated an impressive $225,000—up 120% week-over-week and a surprise for many. Almost certainly, this growth is linked to the real-world assets that are rapidly expanding on Arbitrum, which just passed a fresh milestone of $300 million in total value locked. Last week, @arbitrum protocols generated $1.43M in revenue (+23% WoW). Ostium’s revenue surged 120% last week, likely boosted by Arbitrum RWAs hitting a $300M ATH. @GMX_IO : $550k @OstiumLabs : $225k @GainsNetwork_io : $120k @pendle_fi : $85k @Uniswap : $82k pic.twitter.com/8wUelTq5VY — Entropy Advisors (@EntropyAdvisors) June 24, 2025 After GMX and Ostium, the next best revenue-generating source in our ecosystem was Gains Network, which produced $120,000 in revenue for us. Pendle Finance added $85,000 to the coffers, while Uniswap on Arbitrum produced $82,000. These numbers serve to illustrate one thing above all: an ecosystem that is engaging more and more protocols and generating much more than just a few protocols worth of revenue. An ecosystem that is gaining traction and becoming more established is evident among the developing sectors of DeFi—derivatives, RWAs, yield trading, and AMMs. They point to an established, traction-gaining, ecosystem maturing in decentralization. Of course, this ecosystem relies on diversifying revenue streams. The Market Cap-to-TVL Ratio: A Key Metric Revisited In the earlier cycles of DeFi, investors frequently turned to the market cap-to-TVL ratio as a trustworthy mechanism for pinpointing underrated projects. A ratio that came in below 1 generally suggested that a protocol’s token was trading at a discount in comparison to the quantity of capital that was locked within its ecosystem. As a historical note, during the bear phase of the crypto market, projects that had ratios that were low tended to come back and grow in a substantial way when the overall sentiment of the market turned around. Right now, Arbitrum’s market cap-to-TVL ratio is 0.67, according to DefiLlama. This figure is quite low relative to the rest of the chains and protocols out there. And it seems to intimate that Arbitrum is trading at a pretty hefty discount to its real-world usage and the value it has locked up. This is even more compelling because Arbitrum keeps gaining traction in DeFi, coupled with a strong developer and user base. This low ratio might not be just a metric—it might be the market underestimating the protocol’s long-term value. If history serves, these inefficiencies in crypto markets don’t tend to last long, especially under the current conditions of a reversion-to-mean. $ARB: Oversold or Forgotten? The performance of the price of Arbitrum’s native token, $ARB, represents perhaps the biggest disconnect with public perception. $ARB reached its all-time high on January 12, 2024, but it has since declined—a rough estimate is 86.5 percent—approximately 545 miles (876 kilometers) down the price scale to where it was likely headed all along, the not-exactly-bullish suburb of $0.45. Part of what makes this price decline look and feel so grim is how relatively quickly it happened. Why Arbitrum Might Be DeFi’s Most Undervalued Bet Right Now In the golden years of DeFi, one of the best strategies for spotting undervalued protocols was targeting those with a market cap-to-TVL ratio below 1. It signaled that the protocol’s value was lagging behind the… pic.twitter.com/3WTTji7cK0 — CryptoJZ (@0xCryptoJZ) June 24, 2025 Still, for those in the DeFi space for the long haul, this recent kind of price drop could actually be a not-so-terrible chance to scoop up tokens at bargain levels. With the protocol itself seeming to get more and more robust by the day—its revenues growing, its TVL soaring, its use cases multiplying—there’s a case to be made that the token is undervalued at the moment. If the market should see a new influx of interest in altcoins and DeFi, Arbitrum’s strong fundamentals could see it bounce back sharply. Growth in sectors like real-world assets and perpetuals—plus improved revenue metrics—means the chain is better poised than a lot of its competitors to take advantage of a new wave of cap in-flow. More analysts and investors are keeping a close watch on the project as they lead into the next market cycle, and that is coming about because of two things: the valuation of $ARB is low, and the protocol is gaining real momentum. Conclusion While Arbitrum may not be the talk of the town on a daily basis, it is steadily and quietly constructing a powerful narrative. It is asserting itself as one of the most undervalued ecosystems in crypto. With a diverse panel of revenue-generating protocols, a very favorable market cap-to-TVL ratio, and rising activity in real-world asset integrations, the network continues to show fundamental strength. Recent price declines haven’t changed the data, and that data still puts Arbitrum in a solid position to take advantage of future growth in the decentralized finance, or DeFi, space. Most analysts see the DeFi market recovering, with much of the upward force coming from a wave of new token projects that are set to launch soon. If Arbitrum’s position to gain from that space it is in is anything to do by, we could be seeing a wave of new tokens that are very much in the markets’s favor. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news !