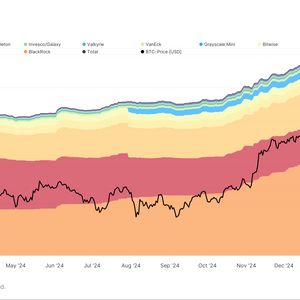

Commenting on an X post about the high speed of crypto adoption, Coinbase CEO Brian Armstrong said that several billion people will be using Bitcoin by 2030. Armstrong was commenting on a post that shares the statistics from the recent BlackRock study. It says that crypto hit the 300 million users landmark in just 12 years. Allegedly, it is 43% quicker than a mobile phone adoption and 20% quicker than an Internet adoption. It really depends what you count as the official start year – for Bitcoin, Internet, and mobile phones – to make this comparison. But regardless, this is directionally correct. Bitcoin adoption should get to several billion people by 2030 at current rates. https://t.co/JEU8P7YmLP — Brian Armstrong (@brian_armstrong) February 10, 2025 Reposting this post, Armstrong added that the estimation may vary depending on what we see as the starting day of the Internet or mobile phone adoption, but he agrees with the overall direction of the BlackRock findings. Coinbase CEO concluded that by 2030, several billion people will be using Bitcoin. You might also like: Crypto adoption beats mobile phones by 43% and Internet by 20%, reports BlackRock BlackRock study According to a BlackRock study released in January 2025, Bitcoin experienced rapid adoption, quickly attracting the attention of both individual and institutional investors. The study stresses the increasing relevance of Bitcoin in times when the general public loses trust in traditional financial institutions. More than that, the study outlines the global trend aimed at making digital money easier for the masses. The study suggests it took 21 years for mobile phones to reach the 300 million users mark. The count begins with 1972, when the first cellular mobile phone was used. The same amount of users was reached by the Internet in 15 years, starting with 1983, the official year of the Internet creation. On top of the questionability of the dates chosen as the starting dates for the Internet and mobile phone adoption expressed by Brian Armstrong, some people question the methodology used to count the number of Bitcoin users. What counts as a user in this? I think it might be the number of addresses, but keep in mind that many of these haven't been touched in years. Also, one person can have more than one address. In fact, because of Bitcoin's poor privacy, many people create a new address every… pic.twitter.com/imYux7SWIr — Victor (@VictorMoneroXMR) February 9, 2025 The study doesn’t reveal the source of the number of Bitcoin users and what are the criteria for someone to fit the ‘Bitcoin user’ definition. Other studies According to the Chainalysis article, in December 2018, of 460 million Bitcoin addresses, only 172 million addresses had economic relevancy . The article notes that 25 million addresses were associated with private holders, while the rest were the addresses of exchanges, dark web marketplaces, and other platforms. This data refers to the times when Bitcoin was ten years old. The number of addresses doesn’t represent the actual number of Bitcoin users or owners, as one person can have a potentially infinite amount of addresses. In contrast, the addresses used on exchanges may be used by several people simultaneously. The BiTBO findings show that only around 106 million people own Bitcoin as of 2025. It is not clear if BlackRock considers ex-owners to be Bitcoin users. According to the study, Bitcoin is used by a mere 500k people a day. For comparison, Visa processes over 700 million transactions daily. Although the Bitcoin network does substantially fewer transactions than traditional payment operators, it allegedly outperforms both Visa and MasterCard in terms of the combined daily value of operated transactions. Bitcoin sends approximately $46.4 billion per day, while Visa operates around $38.9 billion per day, and MasterCard transacts around $24.7 billion each day. Does Armstrong’s prediction look realistic? Comparing Bitcoin to cell phones in terms of adoption is pretty hard, considering that phones are getting increasingly cheaper while Bitcoin is getting more expensive. The modern-day services are designed for smartphone owners, while Bitcoin enthusiasts have to look for opportunities to buy, store, or spend crypto in spite of hurdles. At large, these differences can be attributed to the fact that Bitcoin is much younger than the first commercially available cell phone that hit the market in 1984. More than that, cellphones were never deemed ‘crime telephones’ or something like this, while Bitcoin is still seen as drug money or a tool for money laundering and corruption by some. Bitcoin is a tough war on the part of several governments, but that’s not something that mobile phones have gone through. It took around 30 years for cell phones to become ubiquitous. By 2014, the number of active cell phones had reached around 7 billion. By 2005, when mobile phones were on the market for 21 years, over 60% of adults in the U.S. owned them. In 2030, Bitcoin will be 21 years old, and it doesn’t seem that it will be as widespread as cell phones in 2005. It takes great effort from regulators and businesses around the world to make Bitcoin as simple and safe to use as mobile phones to make billions of people use it. El Salvador made a bold move by making Bitcoin a legal tender. Still, it retreated after a three-and-a-half-year experiment with data showing that most residents didn’t even try to use Bitcoins despite the fact that it was legal and encouraged by the government. This lesson shows that despite Bitcoin seeming handy and prosperous to crypto industry professionals, for the masses, using Bitcoin is still a challenge. Considering how bullish on Bitcoin the governments and corporations are, the adoption may see vertical rise soon, however, the existing challenges cannot be ignored. You might also like: El Salvador ends Bitcoin as legal tender — Here’s why it didn’t work