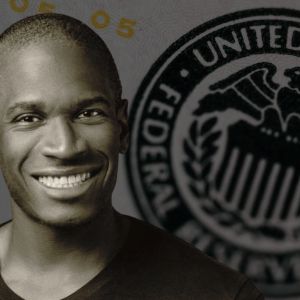

BitMEX founder and longtime trader Arthur Hayes said on Wednesday that the Federal Reserve has hit a wall. He posted on X that “the Fed is on the clock, shit is breaking down.” He said stock prices are falling while the 10-year Treasury yield is rising, calling that a sign of collapse. Arthur explained that in the past, both stocks and the 10-year yield would fall together, which was fine. But now, yields are rising while stocks are crashing, and that, he said, is a problem. “Stocks down, 10-yr yield up, bad! (now),” he wrote. Arthur added that when there are fewer dollars from exports, there’s no money left to buy Treasuries or equities. His final line: “Game Over!” Source: Arthur Hayes (Twitter/X) Arthur says markets are waiting for the Fed’s next move In another post , Arthur warned that if the Treasury cancels upcoming 10- and 30-year bond auctions and starts using the Treasury General Account instead, that would be secret money printing. He said this would be a way to calm things down before “cuck JAYPOW does his duty.” In Arthur’s words, the “elephant walk party begins shortly.” He said no matter what Powell does next, it’ll involve more money printing. “Yachtzee! We are green lit for Fed intervention,” he added. The rest of the market moved fast. On Tuesday, traders increased bets that the Fed will begin cutting interest rates in May. Those bets jumped from 40% earlier in the day to 56% by the afternoon. The change came after Donald Trump’s White House confirmed that more tariffs on Chinese imports will begin on Wednesday. That added pressure to an already slowing economy. Traders expect four more cuts before the end of 2025, based on CME Group futures. Bond market reacts as Powell stays quiet While Arthur posted about collapsing liquidity and money printing, bond yields surged. The 10-year Treasury yield shot up 12 basis points to 4.386%. It even went above 4.5% overnight. That’s the highest level since February. Fixed income, usually the safe zone, is getting dumped. The 2-year yield also moved up, hitting 3.76%. That’s a two-point gain, and one basis point equals 0.01%. The last time the Fed had to choose between slowing inflation and supporting the economy like this was in the 1980s. That’s when Paul Volcker picked inflation and slammed rates so high it triggered a recession. This time, Jerome Powell is boxed in. He missed inflation in 2021, calling it “transitory.” That same word is now being used again by Powell’s team to downplay the impact of tariffs. But the numbers are already reacting. Yields are moving, and the stock market is tanking. The White House had claimed the tariffs were helping by pushing rates lower. That didn’t hold. The bond market pushed the 10-year yield back above where it was before Trump announced the tariffs last Wednesday. Ed Yardeni, president of Yardeni Research, said Tuesday night that “Trump administration officials have been taking credit for the recent drop in bond yields and mortgage interest rates.” He pointed out that the 10-year Treasury yield jumped from 3.87% on April 4 to 4.36% by Tuesday evening. He said investors might be afraid that countries like China could start dumping U.S. Treasuries. That kind of fear adds even more pressure on Powell. If foreign buyers pull out of Treasuries, yields will climb faster. That means higher costs for housing, borrowing, and business across the board. But Powell hasn’t done anything yet. He hasn’t cut rates, and he hasn’t said what comes next. The problem is that if the Fed does cut now, it could help short-term interest rates. But it could also make long-term rates climb even higher. Traders would see it as the Fed giving up. That would scare investors and increase inflation expectations. So cutting rates could actually make inflation worse, not better. Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now