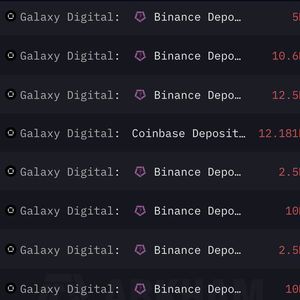

Key Takeaways: Trade wars and a 2.30% dollar decline now fuel Schiff’s prediction of BTC collapse in 2025. Bitcoin ETFs lost $871.6 million over six days despite BTC’s slow recovery. China imposes a 125% retaliatory tariff, intensifying market uncertainty. Peter Schiff, a staunch advocate for gold, has reignited the debate about Bitcoin’s future, asserting that “the financial crisis of 2025 will kill” the cryptocurrency. Schiff, who has long been a Bitcoin critic, argues that the digital asset is too volatile to survive another major economic downturn. Satoshi Nakamoto’s Bitcoin Design Flaws Projected to be Exposed In an X post on April 10, Peter Schiff shared his provocative claim, which was rooted in the creation of Bitcoin. Bitcoin was born out of the financial crisis of 2008. Ironically, the financial crisis of 2025 will kill it. — Peter Schiff (@PeterSchiff) April 10, 2025 Bitcoin was introduced in response to the 2008 global financial crisis, which was triggered by the collapse of major financial institutions due to risky lending practices and the bursting of the housing bubble. This crisis sparked widespread economic turmoil, causing massive unemployment, a sharp decline in global markets, and a lack of trust in banks and government-backed currencies. Amid this instability, an anonymous individual or group under the pseudonym Satoshi Nakamoto introduced Bitcoin in 2008 through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” Bitcoin offered an alternative to the existing financial system, allowing individuals to send and receive payments directly without relying on intermediaries like banks. Peter Schiff believes that just as Bitcoin emerged as an alternative to the traditional financial system during the 2008 crisis, it will inevitably fail during the ongoing major economic collapse in 2025. His projection comes as stock markets have recently suffered significant losses following President Trump’s announcement of sweeping tariffs on imported goods on April 2. Is Trump deliberately crashing markets to refinance $7 trillion in U.S. debt? On April 2, 2025, Trump announced massive tariffs. Markets tanked. Bonds soared. Panic ensued. But what if this chaos… is part of a calculated plan? Let’s break it down with facts, history, and… — CA Vivek Khatri (@CaVivekkhatri) April 4, 2025 On the same day, over two trillion dollars were wiped out of the U.S. stock market in a short time.The Nasdaq Composite plunged 11.4%, the S&P 500 dropped 10.5%, and the Dow lost 9.4% on April 3 and April 4. Stocks, crypto, and nearly every asset class turned red, marking one of the worst crashes in recent memory. Additionally, Bitcoin Exchange-Traded Funds (ETFs) also recorded nearly $900 million in outflows over the past six consecutive days. Gold vs. Bitcoin Outlook: Gold Hits Record Highs as U.S. Bitcoin Reserve Faces a 12% Loss Peter Schiff’s objections to Bitcoin include the U.S. government’s establishment of a Bitcoin reserve alongside Michael Saylor’s ongoing BTC purchase. As CEO of Strategy, Saylor’s firm holds 528,185 BTC . In a recent X post, Schiff explained that since President Trump established a Strategic Bitcoin Reserve, the value of the Bitcoin held in that reserve has plummeted by more than 12%. Peter Schiff’s critique remains clear. He contended that the U.S. would have avoided this loss and even experienced a 2% gain if the government had sold off its Bitcoin reserves and invested in gold. A month ago on Mar. 6th, Trump established the Strategic Bitcoin Reserve. So far, the value of the Bitcoin held in that reserve has declined by over 12%. Had the U.S. sold it and added to our gold reserve, not only would we have avoided that loss, but we would now have a 2% gain. — Peter Schiff (@PeterSchiff) April 7, 2025 Meanwhile, gold has increased in value, reaching a new record high of $3,175 on April 9, and is currently trading at $3,221 at press time. Gold’s resilience contrasts sharply with Bitcoin’s current performance, which continues to slide downward due to market uncertainty. These dramatic price swings raise questions about Bitcoin’s legitimacy as a store of value. Schiff had previously argued that Saylor and other Bitcoin advocates could soon confront a harsh financial reality. Attention @saylor , now that Bitcoin is below $80K, if you want to prevent it from crashing below your average cost of $68K, you had better back up the truck with borrowed money today and go all in. — Peter Schiff (@PeterSchiff) April 6, 2025 He noted that if the Strategy CEO truly believed in Bitcoin, he should go all in and back up the truck with borrowed money to maintain his company’s average purchase cost. Despite 90-Day Trade Tariff Pause, U.S. Dollar Loses 2.30% On April 9, President Trump made a surprise move, announcing a 125% tariff hike on Chinese imports while delaying tariffs for other countries by 90 days. The immediate effect was a relief rally in financial markets as stocks surged across the board. The Dow Jones Industrial Average spiked by nearly 8%, the S&P 500 jumped by 9.5%, and the Nasdaq posted an explosive 12.2% gain, the biggest single-day rise since 2001. Global markets followed suit, with major European and Asian indices also seeing substantial gains. However, Peter Schiff remained unimpressed by the temporary relief in financial markets. In a follow-up post, Schiff pointed out that while stocks and gold surged, the U.S. dollar suffered one of its worst days, falling sharply against foreign currencies. The currency lost over 2.3% against the euro and yen and 3.9% against the Swiss franc. Here is a recap of the day. The dollar had one of its worst days ever. It lost over 2.3% against the euro and yen, and 3.9% against the Swiss franc. Gold surged to another record high above $3,175, up more than $90 today and $100 yesterday. Treasury bonds got clobbered with the… — Peter Schiff (@PeterSchiff) April 10, 2025 He noted that the continued weakness of the dollar raised the question of whether the U.S. was winning the trade war. The gold advocate comments echoed throughout the crypto community as investors braced for more uncertainty amid escalating trade tensions, including China’s new retaliatory tariffs of 125%. The post Peter Schiff Warns 2025 Collapse Could Wipe Out Bitcoin – Is This the End for Crypto? appeared first on Cryptonews .