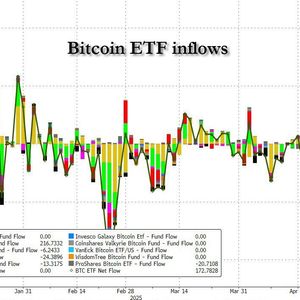

U.S. Bitcoin exchange-traded funds (ETFs) experienced a break in their eight-day inflow streak on April 30, 2025, with $56.3 million in outflows, attributed in part to investor caution ahead of GDP and PCE data releases. Despite this, April saw a total inflow of approximately $2.96 billion into Bitcoin ETFs, with holdings increasing by 32,521 BTC to a record 1,337,814 BTC valued at $128 billion, representing 6.4% of all Bitcoin ever to exist. The U.S. market dominates with an 87% share of global Bitcoin ETF holdings. On May 1, Bitcoin ETFs returned to net inflows, gaining $422.5 million, led by BlackRock, which accounted for $351 million of the inflows and has maintained a 13-day streak of buying 37,000 BTC. This renewed inflow coincided with Bitcoin prices hovering just below $97,000 and the cost basis ribbon for short-term holders indicating a return to profitability, signaling potential positive market momentum. Meanwhile, Ether (ETH) ETFs showed weaker performance, with continued net outflows on May 1, despite a $6.5 million inflow on the same day and ETH prices holding above $1,800. Fidelity has been the main buyer in ETH ETFs recently, while Grayscale has seen notable sell-offs. The slight outflow on April 30 and early May was linked to investor caution around economic data, but inflows resumed as prices recovered, with BlackRock playing a key role in sustaining ETF demand. This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz . To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io