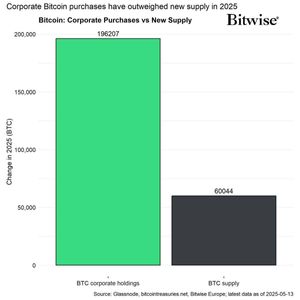

Bitcoin’s recent price stagnation below the $150,000 mark can be attributed to short-term holders exiting the market, according to Michael Saylor, founder of Strategy. Speaking on the Coin Stories podcast with Natalie Brunell on May 9, Saylor explained that a market rotation is underway, with non-long-term holders cashing out and a new wave of committed investors entering. “A lot of Bitcoin, for whatever reason, was left in the hands of governments, lawyers, and bankruptcy trustees,” Saylor noted . “These parties don’t have a 10-year mindset and are seizing the rally as an opportunity to liquidate.” Bitcoin is Finding its Way into Institutions He added that Bitcoin is now finding its way into the hands of institutions and investors with a longer time horizon, particularly through spot Bitcoin ETFs and corporate treasury strategies. After hitting a record high of $109,000 on Jan. 20, just before Donald Trump’s inauguration, Bitcoin dropped as low as $76,273 in early April. However, the asset rebounded to reclaim the $100,000 level on May 8 following renewed geopolitical tensions and Trump’s proposed tariffs. According to Farside data, spot Bitcoin ETFs have attracted $564.7 million in inflows over the past five trading days. Saylor also pointed to his firm’s growing gains: Strategy’s Bitcoin holdings are now over 50% above their average acquisition cost of $68,569. As of now, the company owns 555,450 BTC, worth roughly $57.2 billion, according to data from Saylor Tracker. Kids Get Bitcoin pic.twitter.com/b0LU1MHA3C — Michael Saylor (@saylor) May 9, 2025 Commenting on the U.S. government’s Strategic Bitcoin Reserve, which was created by an executive order from President Trump on March 7, Saylor said he was surprised by how quickly the administration adopted a pro-Bitcoin stance. “I didn’t expect all the Cabinet members to be so enthusiastic,” he remarked, though he acknowledged that the government has yet to actively accumulate Bitcoin beyond seized assets. With momentum building, Saylor believes that the current shift in investor base could pave the way for a sustained rally and a stronger, more resilient Bitcoin market. Bitcoin Stalls Near $103K as Indicators Flash Consolidation — Is a Breakout Imminent? Bitcoin is trading around $103,200 in a consolidation phase, according to the 1-minute chart. Bollinger Bands are tightening, signaling reduced volatility, while the RSI remains neutral near 51, and MACD shows weak bearish momentum. Short-term volume spikes have not triggered sustained trends, suggesting market indecision. On the 30-minute chart, Bitcoin maintains its bullish structure following a strong rally from below $88K. However, momentum appears to be fading. RSI is drifting downward from slightly overbought levels, and MACD is flattening despite staying in positive territory. Bollinger Bands are narrowing again, pointing to a cooldown. Overall, Bitcoin is at a technical crossroads . Key resistance lies at $103,340, with support around $102,800. A breakout above resistance could reignite upward momentum, while a failure to hold support may lead to a short-term retracement. The post Saylor Says Bitcoin Stalled Below $150K on Weak Hands as Bulls Eye BTC Price Rally appeared first on Cryptonews .