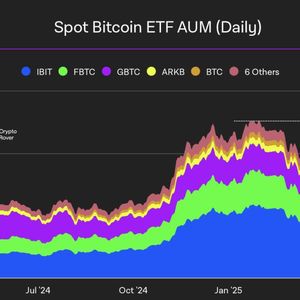

Crypto investment products experienced $882 million in net inflows last week, marking the fourth consecutive week of gains and bringing the year-to-date total to $6.7 billion. Bitcoin led these inflows, accounting for $867 million, with U.S. spot Bitcoin ETFs reaching a new all-time high (ATH) in assets under management (AUM) at $128.03 billion. The total Bitcoin held across U.S. spot ETFs was approximately 1.175 million BTC as of May 9, just 6,500 BTC shy of the previous ATH of 1.182 million BTC. These inflows have offset earlier outflows, signaling renewed institutional demand for Bitcoin, whose market capitalization remains above $2 trillion. Notably, BlackRock's spot Bitcoin ETF, IBIT, recorded the longest streak of net inflows this year, with the firm maintaining a 19-day consecutive net buying streak. On May 12, spot Bitcoin ETFs recorded a net inflow of $5.1 million, continuing a four-day streak of inflows, while Ethereum spot ETFs saw a net outflow of $17.6 million over the same period. Altcoin Sui Network ($SUI) attracted $11.7 million in inflows last week, surpassing Solana ($SOL) in year-to-date flows with $84 million versus $76 million. Additionally, Coinbase experienced its largest 2025 Bitcoin outflow, with over 9,739 BTC (valued at more than $1 billion) withdrawn in a single day, amid growing institutional demand and concerns over a potential Bitcoin supply shock. Following the U.S.-China tariff agreement announcement on May 12, over 3,000 BTC worth $315 million were withdrawn from Binance within one hour. This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz . To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io