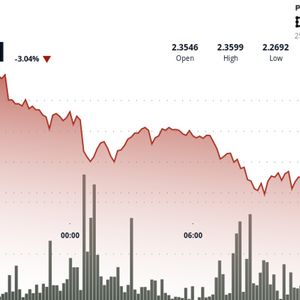

After recently hitting a new all-time high, Bitcoin (BTC) has retraced to the $108,000 level. Still, one whale is betting billions that the number one cryptocurrency will defy the chaos caused by U.S. President Donald Trump’s latest tariff bombshell and rocket to $121,000 within days. The $1.25B Gamble High-stakes trader James Wynn, known for his jaw-dropping leverages, has doubled down on a $1.25 billion BTC long position with 40x leverage, despite a rollercoaster week that saw his unrealized losses briefly hit $321 million. “THE SWINGS ARE INSANE,” Wynn tweeted Thursday after clawing back to a slim profit. “WHALES WANT ME GONE!!!” According to market tracker Lookonchain, his liquidation price is $105,180, which, at Bitcoin’s current value, is just a 3.5% dip away from total wipeout. However, the razor-thin margins seem not to have affected the trader’s bullishness, proclaiming a target for BTC in the coming week. “$118k – $121k next week,” he posted on X Saturday morning, doubling down even as volatility surged. Not long after, he returned to the social platform, sharing a screenshot showing $4.2 million in unrealized profit on one of his trades, which had earlier been $59 million underwater. “Built different,” the self-described meme coin maxi flexed. Can the Market Keep Up? But not everyone is buying the hype. Analyst Daan Crypto Trades called Wynn’s trade “insanity,” arguing that closing even a fraction of his position could shift Bitcoin’s price. “Every 1% BTC candle equals a $10M PNL swing,” he warned. Another pseudonymous market watcher, Innerdevcrypto, speculated that Wynn’s public bravado might be a play for clout. “That liquidation price is too close,” he pointed out. “I wonder if there is not some ulterior motive to him doing this.” To add fuel to the fire, President Trump’s latest tariff threats, including a 50% import tax on EU goods and a 25% Apple-specific levy, have shaken global markets. Bitcoin slipped over 3% on Friday, briefly dipping to around $107,600, with crypto intelligence platform Santiment warning the development had caused traders to change strategies to “holding and ‘hoping for the best.’” Meanwhile, Lookonchain revealed that Wynn had dumped his ETH and SUI longs, burning $5.3 million in losses, to go all-in on BTC. That kind of conviction, or recklessness, depending on your point of view, has set the stage for what is sure to be an interesting new week. Will the maverick whale’s $121,000 prediction come true to see him win big, or will he be eaten alive by the sharks circling around $105,000? UPDATE: More recent data from Lookonchain, though, shows that Wynn closed the entire $1.25 billion long position a few hours ago, which even caused a price slip for BTC on Hyperliquid. Top trader @JamesWynnReal closed all 11,588 $BTC ($1.25B) long positions an hour ago, losing ~$13.4M. The price of $BTC on Hyperliquid dropped by 1.3%. https://t.co/IUTpCuzoSB https://t.co/XC9qCI5NmO pic.twitter.com/GcaqxpPc2A — Lookonchain (@lookonchain) May 25, 2025 The post Bitcoin to $121K Next Week? Mega Whale Wynn Bet $1.25B on It appeared first on CryptoPotato .