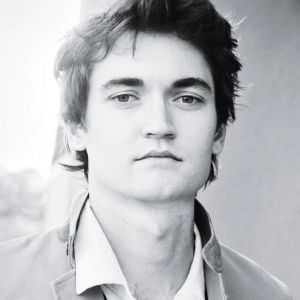

Acheron Trading has become the first CASP-licensed crypto market maker. It can now offer its services to users across the European Union under the MiCA regulations. According to a press release sent to crypto.news, the Singapore -based crypto market maker has recently been issued a Crypto-Asset Service Provider license or CASP license. The license was granted by the Dutch Authority for the Financial Markets, therefore Acheron was be included within the AFM’s public register as well as with the European Securities Markets Authority. Before Acheron, no dedicated crypto market maker has ever succeeded in gaining a CASP license under the current Markets in Crypto-Assets Regulation or MiCA . As of January 2025, the AFM only granted CASP licenses to a total of 4 crypto firms. According to the agency’s website , crypto companies registered under the De Nederlandsche Bank or DNB must obtain a license from the AFM or another European supervision authority by 30 June 2025 at the latest if they wish to continue operating in the EU . You might also like: OKX expands services across 28 EEA nations with MiCA license Acheron Trading has become the first market maker in the crypto space to secure a CASP license, allowing the firm to offer its market making services across the European Union. Established in 2018, the company is trusted by over 400 issuers to distribute their assets to the market. CEO of Acheron Trading, Laurent Benayoun, stated that Europe has seen a steady surge of crypto adoption, with more investors from various backgrounds —whether they are retail, corporate, or institutional investors— flocking to digital assets. This makes the EU an attractive market for market makers. “We look forward to seeing more CASP service providers – especially exchanges, licensed in the following months, unlocking the full potential of the crypto market in the EU,” said Benayoun. According to the release, Acheron Trading plans to continue pursuing licenses in other jurisdictions. The firm aims to boost its compliance so that it may keep up with the collective global effort to expand regulatory clarity in the crypto space. The MiCA laws first came into effect on December 30, 2024. The regulations require crypto firms to register for a license under MiCA in order to operate within the European market. You might also like: Circle’s Head of Policy advocates for MiCA broadening crypto regulations