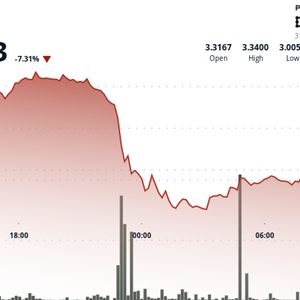

Bybit delisted GMEUSDT on March 25, 2025, citing failure to meet listing standards. GME price spiked 15% post-delisting despite earlier dip during low-volume trading. The delisting aligns with Bybit’s broader removal of low-cap tokens amid stricter compliance reviews. Bybit officially delisted the GME/USDT perpetual contract on March 25, 2025, at 9:00 AM UTC. The exchange confirmed that all trading, open orders, and bot activity tied to the contract were disabled. Positions were auto-closed using the 30-minute average index price before delisting. Bybit’s move impacted users involved in trading GME derivatives. Traders saw their positions forcibly closed, with no option to manage exposure or adjust stop-loss levels ahead of time. Immediate Aftermath: Sudden GME Price Spike Despite the delisting, the GME token saw a surprising 15% jump within hours. Before delisting, GME traded near $0.0026. It then surged to a peak above $0.0033, according to CoinMarketCap data, before settling at $0.0030. GME Token Price Spike After Bybit Delisting: Source: CoinMarketCap This sudden spike followed an extended dip earlier that day. The pattern showed a sharp se… The post Why Bybit Delisted GME? Sudden Pump Follows Exit appeared first on Coin Edition .