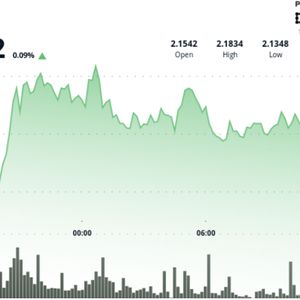

It has been over two months since BTC’s price struggles that pushed it south hard, and the asset plummeted to under $75,000. This enhanced selling pressure transpired during the darkest hours of the global trade war started by US President Donald Trump. Although that political tension has improved a lot since then, with the US striking deals with many countries, including its main rival, China , there’s more uncertainty that has blown off in the past few days. This time, it’s a lot more harmful and has already taken many lives. Operation Rising Lion, launched by Israel on June 13, targeted more than 100 strategic military and nuclear sites in Iran, including facilities in Natanz and Fordow. The most recent reports suggest that the number of killed is nearing 100, which includes senior commanders and scientists, while the injured list is well above 300. Iran responded with Operation Vow of Truth 3, firing countless waves of missiles last night at central Israel, Tel Aviv, Jerusalem, and some targets north. The reported casualties are at least three, while dozens have been injured. While Israel and US President Trump categorized the initial strike as “ preemptive ,” aiming to disrupt Iran’s nuclear progress as the country refuses to sign such a deal, Tehran described its retaliation as defending its sovereignty against direct aggression. Impact on Bitcoin As it happened during the trade war, BTC’s price reacted immediately yesterday to Israel’s attack. In a matter of hours, it plunged from a daily peak of $108,500 to under $103,000. It has recovered some ground and now trades around $105,000, and it hasn’t been significantly influenced by Iran’s response. However, uncertainty persists, and the situation could escalate, potentially leading to further trouble. As such, popular crypto analyst Ali Martinez warned that bitcoin needs to stay within a six-digit price territory; otherwise, it risks plummeting back to under $80,000. #Bitcoin $BTC needs to hold above $100,000 to stay on track for a breakout from this channel. Losing $100,000 increases the odds of a downswing to the channel’s lower boundary at $78,500. pic.twitter.com/cDjURKGlHP — Ali (@ali_charts) June 13, 2025 Large Holders Start to Sell One of the initial warning signs that have appeared is the attitude change by whales. As reported earlier this week, some of the long-term BTC investors had started to dispose of small portions of their holdings, but that was even before the attacks occurred. Martinez noted after the first strike that some of the largest BTC whales—those with more than 1,000 bitcoins—have begun “trimming” their positions. If these sell-offs continue or intensify, they will not only increase the selling pressure on BTC but can also be mimicked by smaller investors. Some of the largest #Bitcoin $BTC whales holding over 1,000 BTC have started trimming their positions. pic.twitter.com/kxYlND5Ohi — Ali (@ali_charts) June 13, 2025 The post Bitcoin’s Price Could Plunge Below $80K Amid Rising Tension and Large Holder Sell-Offs: Analyst Warns appeared first on CryptoPotato .