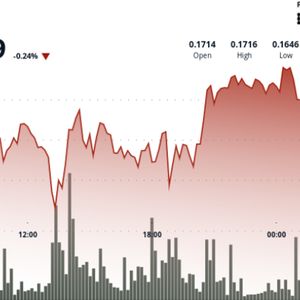

BitcoinWorld Bitcoin Whales and Retail Investors: Powerful Signal as Holding Reaches New Lows Are you tracking the pulse of the cryptocurrency market? One of the most insightful ways to gauge market sentiment is by looking at on-chain data, specifically how investors are moving their assets. Recently, a significant trend has emerged concerning Bitcoin Holding behavior, and it’s catching the attention of analysts. Understanding BTC Inflows: What Do They Tell Us? Exchange inflows refer to the amount of cryptocurrency being sent from private wallets or cold storage onto centralized exchanges like Binance, Coinbase, etc. Why is this data important? Because investors typically move assets onto exchanges when they intend to sell them, trade them for other assets, or use them for short-term activities. Conversely, low inflows suggest investors are keeping their assets off exchanges, often a sign they plan to hold for the long term. Crypto analyst Darkfost recently highlighted a crucial data point on CryptoQuant: BTC Inflows to Binance reached their lowest level since the start of the current market cycle on June 16th. This isn’t just a minor fluctuation; it represents a significant drop-off in the supply of Bitcoin being made readily available for potential selling on one of the world’s largest exchanges. Bitcoin Whales and Retail: A Unified Front? What makes this particular data point so compelling is that this low inflow trend isn’t limited to just one type of investor. Darkfost’s analysis indicates that both large investors (often referred to as Bitcoin Whales due to their massive holdings) and smaller, everyday investors ( Retail Crypto Investors ) are exhibiting this same behavior. This alignment between different market participants is relatively uncommon and carries significant weight. Whales: These entities control substantial amounts of BTC. Their movements can significantly impact market supply and demand. When whales move BTC *onto* exchanges, it often precedes large sell-offs. When they keep it off, it signals confidence or anticipation of higher prices. Retail Investors: While individual retail holdings are smaller, their collective actions represent broader market sentiment. If retail is sending BTC to exchanges in large volumes, it can indicate panic selling or profit-taking. Low retail inflows suggest they are content to hold. The fact that both groups are showing synchronized low inflows suggests a widespread conviction to hold rather than sell at current price levels. This could indicate: Strong belief in Bitcoin’s long-term potential and higher future prices. A strategic pause, waiting for clearer macroeconomic signals (like interest rate decisions or inflation data) before making major moves. An accumulation phase where investors are buying dips and transferring BTC to cold storage. What Does This Signal for Crypto Market Sentiment? This coordinated holding pattern is generally interpreted as a positive sign for overall Crypto Market Sentiment . Reduced selling pressure from both major and minor players removes a significant potential headwind for price appreciation. While it doesn’t guarantee immediate price pumps, it builds a foundation for potential future rallies by limiting the available supply on exchanges. Think of it like a supply squeeze – if fewer people are willing to sell, even modest buying pressure can have a more pronounced effect on price. Historically, periods where investors show a strong propensity for Bitcoin Holding , especially when confirmed by low exchange inflows, have often preceded upward price movements. It suggests the market is in an accumulation or holding phase, where participants are positioning themselves for future gains rather than exiting their positions. Challenges and Considerations While low inflows are a bullish indicator, it’s important to consider the full picture. Other factors influencing the market include macroeconomic conditions, regulatory news, institutional adoption, and global events. Additionally, some large transactions occur off-exchange (OTC deals), which wouldn’t show up in exchange inflow data. However, the consistent low inflow trend across both whale and retail addresses onto major exchanges remains a compelling data point. Actionable Insight For investors tracking the market, paying attention to on-chain metrics like exchange inflows can provide valuable context beyond just price charts. While not financial advice, understanding that large segments of the market are choosing to hold rather than sell can help inform your own perspective on current market strength and potential future direction. Compelling Summary The recent data showing historically low Bitcoin inflows to Binance from both whales and retail investors is a powerful signal. It indicates a widespread preference for holding BTC, reflecting either strong long-term conviction or a strategic wait-and-see approach. This synchronized Bitcoin Holding behavior reduces potential selling pressure and is generally seen as a positive underlying factor for the Crypto Market Sentiment , suggesting that many participants anticipate further gains down the line. To learn more about the latest explore our article on key developments shaping Bitcoin price action. This post Bitcoin Whales and Retail Investors: Powerful Signal as Holding Reaches New Lows first appeared on BitcoinWorld and is written by Editorial Team