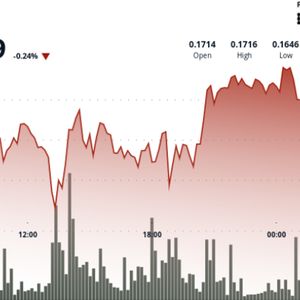

Global stocks edged slightly higher on Monday, June 16, as investors appeared upbeat about a limited escalation of the Israel–Iran conflict. Risk assets were higher in early trading on Wall Street after the Israeli attack on Iran prompted Tehran to respond with missile strikes on Tel Aviv and other locations. Despite the initial negative reaction in the stock market , futures rose as the new week began with optimism that Middle East tensions would not escalate into a full-blown war. This sentiment saw the Dow Jones Industrial Average open 250 points, or 0.6%, higher, while the S&P 500 inched up 0.7% and the Nasdaq Composite opened 1% higher. U.S. equities edging higher also coincided with a spike in Bitcoin ( BTC ) as the global crypto market capitalization increased 2.4% over $3.2 trillion. You might also like: Bitcoin leads $1.9b crypto fund inflows as traders bet on market rebound Elsewhere, oil prices swung lower after buyers exerted some upside pressure. However, the prices were down as fresh jitters swooped in amid the heavy attacks witnessed over the weekend.Gold prices have also seen a slight pullback, currently around $3,440 an ounce Despite the delicate geopolitical situation, U.S. President Donald Trump said on Truth Social late Sunday that a “peace deal” will soon be in place. “Iran and Israel should make a deal, and will make a deal, just like I got India and Pakistan to make, in that case by using TRADE with the United States to bring reason, cohesion, and sanity into the talks with two excellent leaders who were able to quickly make a decision and STOP!,” Trump posted on Truth Social. The Kobeissi Letter shared a similar outlook via X. BREAKING: Iran is reportedly ready to abandon uranium enrichment, but needs a “face saving exit,” per Iranwire. It appears we are on the brink of an Israel-Iran peace deal. — The Kobeissi Letter (@KobeissiLetter) June 16, 2025 The recent market outlook has been one of resilience, with the Dow, S&P 500, and Nasdaq all closing May in the green despite tariffs and interest rate uncertainty. Weak U.S. economic data also had not significantly disrupted the bullish setup. June, however, has seen the major U.S. indexes slide into bear territory over the past trading week. Investors are betting on a swift end to the escalation — something Trump has also commented on, albeit with the caveat that hostilities may yet “play out” before the two sides agree to end the attacks and counterattacks. Also on investors’ minds this week is the upcoming Federal Reserve decision on Wednesday. Consensus expects the Fed to hold rates steady despite Trump’s pressure on Fed Chair Jerome Powell. You might also like: Dow Jones down 500 points on escalating Israel – Iran tension