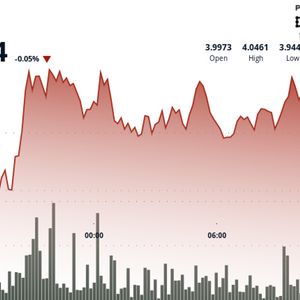

Eyenovia, a publicly trading company, announced it would set aside $50M to buy HYPE tokens and stake them. The potential addition of crypto to the balance sheet aims to revive the company’s flagging shares. Eyenovia is joining the trend of buying altcoins as crypto reserves, in a bid to revive a weakening share price. The company chose HYPE for its reserves, setting aside $50M, a relatively small sum for a crypto treasury. The intention was to purchase HYPE and become a large-scale staker, while also rebranding the company. The main idea behind the altcoin treasuries aims to follow the example of Strategy, Metaplanet, Mara Holdings and other BTC treasury companies, whose shares benefitted from the purchases. However, in the case of Eyenovia, skepticism is accelerating on the viability of a treasury strategy. Altcoins remain more unreliable, with limited institutional demand and lower liquidity. Eyenovia itself is inviting warnings, as the company fired 50% of its staff in 2024, following a failed Stage III trial of myopia tech. Eyenovia, which was a digital ophthalmic tech company, will rebrand to Hyperion DeFi, and change its ticker to HYPD. The HYPE treasury will allow the buyer to become one of the top validators for Hyperchain, tapping into the growing trend of perpetual futures DEX trading. Following the announcement, HYPE still traded in its usual range of $40.52, after falling from a local peak of $45.12. HYPE has been one of the trending tokens, though still lagging in terms of mainstream adoption. The involvement of Eyenovia shows the hype for crypto as a booster for regular companies is accelerating. Eyenovia sold shares through PIPE The latest HYPE purchase will happen through inflows from accredited investors, in a private placement of equity (PIPE). The stock purchase agreement will offer convertible non-voting preferred stock, convertible into 154M of common stock. The conversion is subject to limitations set by company investors. The shares will be convertible at a price of $3.25, with the additional option to buy 30.8M common shares at $3.25. If all options are fulfilled, Eyenovia can raise up to $150M, with no guarantees about the sum or the size and value of crypto purchases. Eyenovia (EYEN) bounced from lows near $2, though still down over 86% from peak valuations. | Source: Google Finance In the short term, the price of EYEN climbed to $6.97, rising from lows of $2 in the past month. However, EYEN has erased over 86% of its value for the past 12 months, starting from above $106. Eyenovia is yet another company with no prior ties to crypto that has seen its shares rebound from lows following hints of crypto purchases. Universal Digital was one of the latest companies to announce a similar approach, though again through accumulating BTC. Classover Holdings also drew attention to itself, with a program to purchase SOL for $500M, financed through a recent stock offering. Other similar cases include DeFi Dev Corp with a $100M purchase, and SOL Strategies with a $67M treasury. The effect on stock prices in this case was disparate, with DeFi Dev Corp. rising to a six-month high, while SOL Strategies trading sideways close to its recent lows. Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More