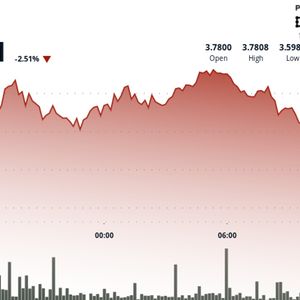

Polkadot DOT encountered substantial selling pressure, dropping as much as 5% before rebounding and potentially forming a double bottom pattern that points to continued upward movement, according to CoinDesk Research's technical analysis model. After initially attempting to establish an uptrend with a peak at $3.787, DOT encountered strong resistance and formed a bearish reversal pattern, according to the model. In recent trading, DOT was 2.6% lower over 24 hours, trading around $3.63 having found support at $3.59. The broader market gauge, the CoinDesk 20, was down 0.5% at publication time. The price action shows a potential double bottom pattern forming with improving momentum, suggesting further upside if it maintains support above the $3.62 price level, the model showed. Technical Analysis: DOT experienced a volatile 24-hour period with a substantial range of 0.193 (5.1%), initially attempting to establish an uptrend with a peak at $3.787 before encountering strong resistance. The price action formed a bearish reversal pattern as DOT failed to hold above the $3.75 level, followed by accelerated selling on high volume during the 10:00 and 13:00 hours when volume spiked to nearly 4 million units — well above the 24-hour average. Support emerged at $3.594, though the current price structure suggests further downside risk as DOT closed near session lows with weakening momentum indicators. In the last hour, DOT experienced significant volatility with a sharp decline from $3.643 to a low of $3.594, followed by a recovery attempt. The price found strong support at the $3.594 level, triggering a V-shaped recovery that pushed DOT up by 1.3% to $3.642. The recent price action forms a potential double bottom pattern with improving momentum, suggesting the possibility of continued upward movement if DOT can maintain support above the $3.62 level. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .