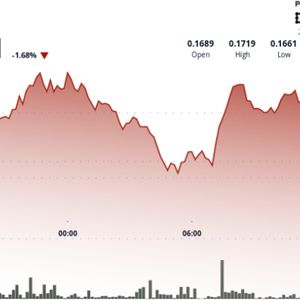

Canada has outpaced the U.S. in launching a second XRP exchange-traded fund (ETF). Crypto asset manager 3iQ introduced the new XRP-focused ETF for North American customers. 3iQ’s XRP ETF Debuts on TSK The 3iQ XRP ETF (XRPQ) started trading today on the Toronto Stock Exchange (TSX), providing investors direct exposure to the fourth-biggest cryptocurrency by market capitalization without them needing to hold the asset itself. According to a Wednesday announcement, Ripple, the creator of the XRP Ledger and XRP, is an early XRPQ investor, though the amount invested was not revealed. The new fund will feature a 0% management fee for the first six months and will invest strictly in long-term XRP positions purchased from popular exchanges and OTC platforms, with all holdings kept safely in cold storage. XRPQ is accessible to qualified international investors, depending on local regulations. “XRP has demonstrated significant growth potential over the past decade, and this groundbreaking strategy offers Canadian and qualified global investors a transparent, low-cost, and tax-efficient way to securely access that opportunity,” 3iQ President and CEO Pascal St-Jean said. We are excited to announce the launch of the 3iQ XRP ETF (TSX: XRPQ, XRPQ.U) — one of the first ETFs in North America to provide exposure to #XRP . XRPQ debuts with a 0% management fee for the first six months, and @Ripple as an early investor in the fund. “The launch of XRPQ… pic.twitter.com/me19RLAzJI — 3iQ Digital Asset Management (@3iq_corp) June 18, 2025 More XRP Funds To Hit The Markets? 3iQ’s launch comes after asset manager Purpose Investments announced it would also begin trading of its spot XRP ETF on the Toronto Stock Exchange on Wednesday under the XRPP ticker. The launches come as institutional appetite for XRP continues to grow, particularly as Ripple and the U.S. Securities and Exchange Commission (SEC) work towards wrapping up their longstanding case . Although the US regulator has already approved spot investment vehicles for Bitcoin and Ether, many investment managers are vying to be the first to be approved for tokens like XRP. According to Bloomberg analysts , spot XRP ETFs in the US have an 85% chance of approval in 2025. The price of XRP is trading at around $2.14 at publication time, down 1.5% in the last 24 hours, per CoinGecko data.