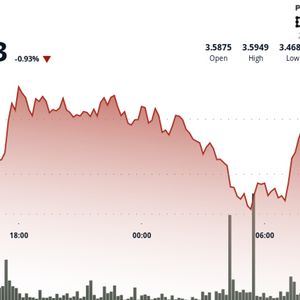

The post Is RAY Price Up for Another Rally After a 600% Volume Surge? appeared first on Coinpedia Fintech News Raydium is gaining renewed investor interest, all thanks to its strong fundamentals. As per recent stats, Raydium boasts a TVL of $1.86 billion and an impressive annual revenue of $655.9 million. What has caught the attention of many is that its capital efficiency metrics shine, it holds a Revenue/Market Cap ratio of 19.2% and TVL/Market Cap of 2.84x. Moreover, with $67.2 million (11.9%) staked, investor conviction appears to be stout. As RAY’s price experiences a sharp intraday rebound, traders are closely watching to see whether this surge signals a broader recovery or short-term volatility. Join me as I derive the Raydium (RAY) price analysis for the near term. RAY Price vs Volatility: Weekly Comparison Recalling numbers from the recent past, as of April 30, 2025, RAY traded at $2.84 with a 1-week price volatility of 0.0609. Fast forward to today, that is, June 19, RAY’s current price stands at $2.27, with a 20% decline from the earlier high. However, despite this drawdown, the token has stabilized and rebounded nearly 10% in the past 24 hours, while weekly gains sit at a modest +1.05%. Volatility seems to have compressed slightly, as reflected in the tighter Bollinger Bands on the chart. This indicates a reduction in price swings and a potential build-up for a new directional move. RAY Price Analysis: Bullish Break or Temporary Spike? RAY’s recent price surge has injected fresh momentum into its price structure. The 4-hour chart reveals a breakout above the midline of the Bollinger Bands in 20 SMA at $2.15, suggesting bullish sentiment is taking hold. Price action pushed through resistance at $2.10 and briefly tested $2.64 before pulling back. At present, the token is trading at $2.27, holding above key short-term support at $2.10. The 10% daily spike was catalysed by a 609% surge in intraday trading volume, which tallied to $401.19 million. A decisive breakout and close above $2.526 could pave the way for a further push toward the target at $2.854. The RSI stands at 58.34, hovering just below overbought territory, implying room for additional upside while still allowing caution for volatility. Also read our Raydium (RAY) Price Prediction 2025, 2026-2030! FAQs What triggered RAY’s sudden price surge? A sharp uptick in volume and breakout above $2.10 support likely led to short-covering and fresh buying, pushing RAY up 9.9% in 24 hours. Is the current trend sustainable? It depends on whether RAY can close above $2.526 resistance with sustained volume. Otherwise, a retest of $2.10 support is possible. What are the next levels to watch? Key levels include support at $2.10, resistance at $2.526, and a breakout target of $2.854.