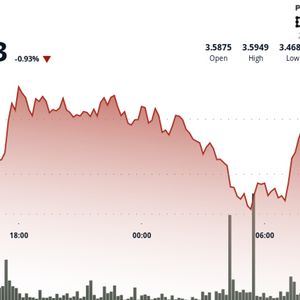

BitcoinWorld Unlocking Altcoin Recovery: Ethereum’s Crucial Role in the Crypto Market Shift Is the much-anticipated Altcoin recovery finally on the horizon? For many investors holding various digital assets, this is the burning question. While Bitcoin often dominates headlines, attention is increasingly turning to Ethereum (ETH) as the potential catalyst for broader market gains. Why is Ethereum Price Key to Altcoin Recovery? According to insights shared by experts like Michaël van de Poppe, founder of MN Trading Capital, the fate of many altcoins is currently tied directly to Ethereum’s performance. He suggests that for investors to see their altcoin positions return to profitability or achieve significant gains, ETH needs to demonstrate stronger momentum and resilience in the market. Think of it this way: Ethereum is the largest altcoin by market cap and serves as the foundation for a vast ecosystem of decentralized applications, DeFi protocols, NFTs, and other altcoins built on its blockchain or EVM-compatible chains. When Ethereum is strong, it signals health and activity in this ecosystem, which often spills over positively into the performance of associated altcoins. Van de Poppe’s view highlights a crucial point: without a robust ETH showing, the capital needed to fuel significant rallies in smaller altcoins might remain stagnant or exit the market. A rising Ethereum price can increase confidence, liquidity, and risk appetite, all essential ingredients for an Altcoin season . Entering the ‘Ethereum Phase’ of the Crypto Market Adding weight to the narrative, on-chain analyst Willy Woo recently posited that the broader Crypto market is transitioning into what he terms an ‘Ethereum phase’. This suggests a potential shift in market dynamics where Ethereum, rather than just Bitcoin, becomes the primary driver or indicator of market sentiment and direction. Michaël van de Poppe agrees with Woo’s assessment of this fundamental shift. However, he notes a common disconnect: many investors remain unaware of this transition. They are still influenced by a lingering ‘markets are bad’ mindset, perhaps conditioned by previous downturns, and haven’t fully grasped Ethereum’s growing influence and potential leadership role in the current cycle. What might an ‘Ethereum phase’ entail? It could mean: Increased focus on Ethereum’s fundamentals (e.g., staking yields, network upgrades, EIPs). Higher correlation between ETH and many altcoins compared to the traditional BTC-altcoin correlation. Ethereum’s price movements acting as a leading indicator for specific sectors within the crypto market (like DeFi or NFTs). Greater institutional interest specifically in Ethereum as a programmable settlement layer and yield-bearing asset. Understanding this potential phase shift is vital for investors looking to navigate the coming months and capitalize on potential opportunities beyond just Bitcoin. Examining the ETH Price Prediction Trajectory Beyond its fundamental role, the technical price action of Ethereum is also generating significant interest. Crypto analyst Ted has drawn parallels between Ethereum’s current trajectory and Bitcoin’s historical price movement during its 2017–2021 cycle. This comparison is significant because Bitcoin’s 2017-2021 period included its massive bull run. If Ethereum were to follow a similar path, it could imply substantial upside potential from current levels. Ted’s analysis suggests that a real parabolic move – a rapid, accelerating increase in price – could commence once ETH decisively breaks and sustains above the $4,000 mark. Hitting $4,000 would not only represent a significant psychological and technical resistance break but would also bring ETH closer to its previous all-time high. Surpassing this level could trigger a wave of positive sentiment, potentially leading to further price discovery and reinforcing the idea that the market is indeed entering a more bullish phase, supportive of Altcoin recovery . Challenges and Considerations While the outlook linking ETH strength to altcoin gains is compelling, it’s important to consider potential challenges: Market Volatility: The crypto market remains highly volatile. Unforeseen macroeconomic events or regulatory news could impact ETH and altcoins negatively. Bitcoin Dominance: While the narrative suggests an ‘Ethereum phase’, Bitcoin’s influence is still substantial. A strong BTC rally that pulls liquidity from altcoins could temporarily hinder the ‘Ethereum phase’ thesis. Execution Risks: While Ethereum’s fundamentals are strong, the successful execution of future upgrades is crucial for its long-term health and appeal. Altcoin Specific Risks: Even with a strong ETH, individual altcoins face unique risks related to their technology, team, adoption, and competition. Investors should conduct their own research and not solely rely on broad market trends or predictions. Diversification and risk management remain paramount. Conclusion: Watching Ethereum for the Next Big Move The consensus among several prominent analysts points towards Ethereum as the primary driver for the next wave of Altcoin recovery . From its fundamental role in the crypto ecosystem to its technical price trajectory mirroring past bull runs, ETH’s performance is seen as the crucial barometer for whether the broader Crypto market can enter a truly bullish phase. The idea of an ‘Ethereum phase’, where ETH leads the charge, is gaining traction, even if many retail investors haven’t fully recognized it yet. While price predictions like the move past $4,000 for a parabolic run offer exciting potential, it’s essential to remain aware of market dynamics and individual asset risks. Ultimately, for those waiting for an Altcoin season , keeping a close eye on Ethereum price action and network developments appears to be the most strategic approach. To learn more about the latest crypto market trends, explore our article on key developments shaping Ethereum price action . This post Unlocking Altcoin Recovery: Ethereum’s Crucial Role in the Crypto Market Shift first appeared on BitcoinWorld and is written by Editorial Team