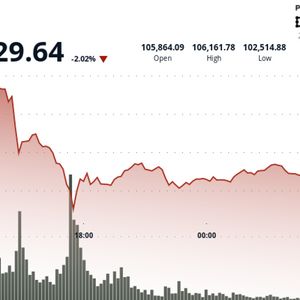

Bitcoin (BTC) has weathered its latest geopolitical storm, sliding 7% from its recent cycle high of $108,652 amid intensifying tensions between Israel and Iran. Yet, despite the uncertainty, BTC continues to trade resiliently above $105,000, suggesting that investors may be bracing for a rebound rather than a collapse. This familiar scenario, panic selling followed by accumulation, is one the crypto market has seen before. $BTC hasn’t reacted that much to Iran Israel war This is showing that sellers don’t have that much strength But this war is causing risk-off strategy in the markets So new investors aren’t coming for now Technical analysis doesn’t help that much here, news are running BTC pic.twitter.com/mIAbfqJyzn — Manbit (@manbitreal) June 14, 2025 Market participants are watching not just the Middle East tensions but also the United States, where former President Donald Trump is expected to decide in the coming days whether the U.S. will take action. These developments are keeping Bitcoin volatile but intact, hovering around $105,948 as of Friday, up 1.03% on the day. Historical Selloffs Often Signal Buying Zones Looking back, Bitcoin has a pattern of sharp selloffs during crises, followed by explosive gains. During the March 2020 COVID-19 panic, BTC crashed 63% to under $4,000 before rallying more than 1,700% to $65,000 within a year. A similar pattern emerged in late 2023 during the Yen carry trade unwind, where Bitcoin dropped 30% only to surge 124% afterward. This week’s 7% pullback, amid fears of Iran-Israel tensions, echoes those earlier episodes. Analysts argue that these dips often act as prime accumulation zones for long-term holders and institutions, especially when the broader macro narrative hasn’t undergone a structural change. Past Recovery Snapshots: March 2020: BTC fell to $3,800 → rebounded to $65,000 (+1,700%) Oct 2023: BTC dropped 30% → rallied to $108,652 (+124%) June 2025: Current dip of 7% → possible reversal underway? If history holds, investors may be seeing a temporary fear-driven shakeout rather than a trend reversal. Bitcoin Technical Setup Shows Potential Breakout Technically, Bitcoin price prediction remains slightly bullish, but it has to break above a critical Fibonacci level at $106,886. It bounced sharply from the $104,800 support, reclaiming its 50-period EMA at $105,254, a sign that buyers are stepping back in. Bitcoin Price Chart – Source: Tradingview The MACD indicator just crossed bullish, hinting at a potential shift in short-term momentum. However, for a clear breakout, BTC must: Close above $106,886 to escape the descending structure Break above the $107,000 trendline to target $107,807 and $108,991 Clear $108,991, which opens the path to $111,239 and $112,354 Support remains firm at $105,254 and $104,800. A breakdown below that range could drag BTC toward more prolonged consolidation. Bitcoin: Final Outlook – Accumulation or Trap? Bitcoin’s reaction to geopolitical shocks has historically been bullish in the long run. With Fed rate cuts still anticipated later in 2025 and no significant change to Bitcoin’s long-term thesis, the current dip could be less about weakness and more about opportunity. However, traders should remain cautious. The current bounce is occurring near previous rejection zones. Whether this marks a bullish continuation or a bull trap will likely be decided in the $106,800–$107,000 zone. A confirmed breakout above $108K would signal the start of a new bullish leg. Best Wallet ($BEST): Crypto Storage Meets Early Access Best Wallet is emerging as a leading crypto platform, combining advanced security with seamless access to early-stage tokens. Available on Google Play and the App Store, it supports over 1,000 cryptocurrencies and is the first wallet to integrate Fireblocks’ MPC-CMP security protocol. One of its standout features is the Upcoming Tokens page, allowing users to purchase presale tokens directly within the app—no wallet connections or external sites required. This secure, no-KYC experience makes Best Wallet ideal for both beginners and seasoned investors. The $BEST token powers the ecosystem, offering reduced transaction fees, higher staking yields, early project access, and governance rights. Users can also earn through in-app quests and airdrops. With over $13.45 million raised and the price now at $0.025205, the presale is gaining momentum. Secure your $BEST allocation before the next price jump, and gain early access to a wallet that’s redefining how crypto enthusiasts and investors interact with digital assets. The post Bitcoin Price Prediction: BTC Repeats Covid & Yen Crash Patterns Amid Iran-Israel Conflict – Buy the Dip? appeared first on Cryptonews .