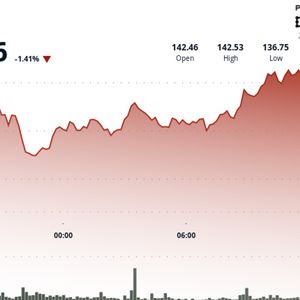

Nearly $20 billion was pulled out of global equity funds last week as the war between Iran and Israel pushed investors straight into panic mode. The massive retreat totaled $19.82 billion by June 18, based on data published by LSEG Lipper, making it the largest weekly outflow in three months. The sell-off landed right as the market braced for a volatile mix of war tensions, stalled US trade decisions, and inflation concerns. Investors yanked $18.43 billion out of US equity funds, the biggest single-week exit since March. Asia followed with $2.86 billion in net outflows. The only region to swim against the tide was Europe, which somehow managed to pull in $640 million. Bond funds attract inflows while sectoral equity bets continue Even with overall stock sentiment turning sour, some sectors still picked up fresh money. Sectoral equity funds attracted $573 million in net inflows, marking a fourth straight week of interest. Technology led the pack with $1.5 billion, followed by industrials at $752 million. Financials went the opposite way, losing close to $1.5 billion in the same period. The real demand was in bonds. Global bond funds received $13.13 billion in net inflows, extending their winning streak to nine weeks. Euro-denominated bonds alone brought in $3.07 billion, after collecting $7.97 billion the week before. Appetite also grew for short-term and high-yield bonds, which pulled in $2.93 billion and $1.94 billion, respectively. Investors also dumped $2.7 billion from money market funds, following the $4.1 billion they had pulled the week before. At the same time, demand for gold and precious metals funds jumped hard — net inflows hit $2.84 billion, the most in two months, as markets clearly started hedging for more risk. Interest in emerging market bonds hasn’t faded. They brought in $2.5 billion, continuing an eight-week run of inflows. But emerging market equities didn’t share the momentum. They lost $234 million, with the data pulled from nearly 30,000 funds. Meanwhile, US stocks ended this week in the red, stuck in limbo while everyone waits for what President Donald Trump decides next. On Friday, Trump said he would wait two weeks before deciding if the US military will support Israel’s campaign against Tehran. This temporary pause calmed nerves after days of harsh rhetoric from the White House. By Closing Bell, the S&P 500 had fallen 0.15%. The Dow Jones inched up just 0.02%, while the Nasdaq rose 0.2%, its third positive week out of the last four. Despite everything going on, many investors can’t figure out how stocks keep climbing. Since bottoming in April, the market has fought its way back, ignoring war, tariffs, and slowing economic signals. Chart watchers are still bullish. IBM is the top name in the Dow Jones this year, gaining 28% and even beating out the Magnificent Seven stocks. Industrials are now the best-performing sector in the S&P 500, which some see as a sign that the US economy still has some muscle. Others think semiconductors are the key to a full breakout. If Nvidia can break past $150 a share, it could drag the index to a new record. Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More