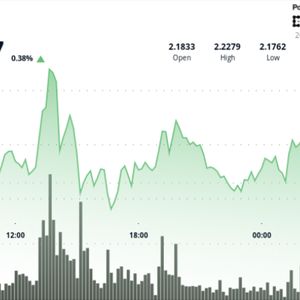

A fragile calm swept across risk assets on Tuesday as U.S. President Donald Trump claimed to have brokered a ceasefire between Israel and Iran, sparking a rally in crypto majors. “Officially, Iran will start the CEASEFIRE and, upon the 12th Hour, Israel will start the CEASEFIRE and, upon the 24th Hour, an Official END to THE 12 DAY WAR will be saluted by the World,” Trump said on his Truth Social account. Ether ETH, Solana's SOL SOL, and Cardano's ADA ADA surged around 7% in the past 24 hours. Ether climbed back above $2,400, while SOL and ADA rose over support at $140 and 50 cents respectively. Crypto trading volumes also rebounded after a brutal Sunday-Monday flush that saw nearly $600 million in long liquidations. XRP XRP, BNB Chain’s BNB BNB, and dogecoin DOGE also rose between 4%-6%. The broader CoinDesk 20 CD20}], a liquid index tracking the largest tokens, rose over 3%. The bounce followed a wave of macro relief. Brent crude slipped 1.8% and S&P 500 futures turned positive, even as the ceasefire lacked formal confirmation from either government. But traders were quick to rotate back into altcoins, betting on a volatility cooldown. “We think the market will soon normalize and move on from the latest geopolitical episode,” said Augustine Fan, head of insights at SignalPlus. “But we’re more worried about a bigger shake-out to stop out recent longs… and the negative FOMO signals from all the public companies looking to establish new BTC treasuries as their latest financial engineering gig,” Fan added. Meanwhile, Bitcoin {{BTC continues to consolidate near $105,000, testing overhead resistance as institutional flows hold steady. Some see structural strength in the asset's performance over the past few weeks. “Its ability to hold above $100K underscores resilience amid geopolitical and macro volatility,” said Kay Lu, CEO of HashKey Eco Labs, told CoinDesk. “As institutional inflows and ETF demand rebound, BTC’s decoupling from traditional risk-off signals suggests a maturing role as a macro hedge in the long term,” Lu added. Still, some traders caution that the next leg of the move could be driven by profit-taking, especially in overheated tokens, such as ether. Read more: Bitcoin Busts Past $106K on Reported Iran/Israel Ceasefire