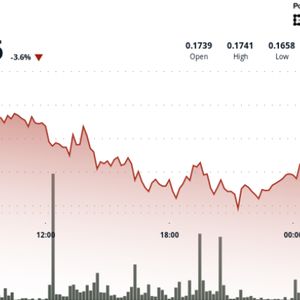

Dogecoin has stabilized near $0.17 after a 4.6% decline, with strong support forming at the $0.166–$0.167 zone. Despite recent weakness, the surge in large wallet accumulation and easing macro headwinds point to potential bullish continuation if price can break through technical resistance zones at $0.18, $0.21, and $0.36. News Background The cryptocurrency market is navigating a tense macro backdrop as escalating trade disputes and shifting central bank policies weigh on risk assets. The temporary extension of the U.S. “Liberation Day” tariff pause to August 1 has offered some relief, while major banks now anticipate Federal Reserve rate cuts between 0.25% and 1% starting as early as July. Meanwhile, Elon Musk’s surprise announcement of The American Party —a political platform rumored to incorporate blockchain-powered finance —has reignited interest in Dogecoin, particularly among large holders. Whale accumulation of DOGE is up 112% over the past week, even as retail interest declines. Analysts believe the asset is coiling within a multi-year cup-and-handle pattern that, if confirmed, could target levels as high as $0.75. For now, DOGE remains pinned beneath resistance but is showing early signs of bullish reaccumulation at key support. Technical Analysis From 7 July 05:00 to 8 July 04:00, DOGE fell from $0.174 to a low of $0.166, marking a 4.6% decline over the 24-hour period. Strong volume-supported support emerged between $0.166–$0.167 during the 13:00 and 16:00 hours on 7 July. Price stabilized and modestly recovered to $0.168 in the final hours, with decreasing volatility signaling potential trend exhaustion. Between 8 July 03:38 and 04:37, DOGE exhibited a strong hourly recovery from $0.1672 to $0.1680, with a key breakout at 04:29–04:31 supported by 4.1M volume. A higher low formed at $0.1679, suggesting a potential shift in momentum and a foundation for short-term bullish continuation.