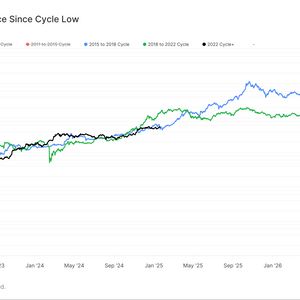

The post Bitcoin Poised for Major Breakout Ahead of FOMC Meeting, Says Analyst appeared first on Coinpedia Fintech News Bitcoin could be on the verge of a major price move, according to Markus Thielen, head of research at 10x Research. He believes Bitcoin is trading within a narrowing wedge, which usually signals an upcoming breakout. With the Federal Open Market Committee (FOMC) meeting set for January 29, Thielen expects a significant shift in Bitcoin’s price by the end of the month. Bitcoin Signaling A Breakout As per the Thielen analysis , Bitcoin continues to trade within a narrowing wedge pattern, signaling a breakout is imminent. He further noted that several key factors, including inflation data and Federal Reserve policies, are shaping market expectations. Are Smart Traders Hedging #Bitcoin with #Altcoin Shorts? 1-12) Bitcoin continues to trade within a narrowing wedge, with several critical catalysts on the horizon. Expectations for a higher CPI number have risen, creating a scenario where a softer-than-expected inflation… pic.twitter.com/K1dmddRUop — 10x Research (@10x_Research) January 14, 2025 Thielen advises traders to focus on the direction of the breakout rather than attempting to predict its course. He notes that expectations for higher inflation numbers, reflected in the Consumer Price Index (CPI), could significantly influence market dynamics. A softer-than-expected inflation reading might trigger a Bitcoin rally , aligning with 10x Research’s earlier forecast of a moderately positive January. Meanwhile, he noted that a deeper dip below $90,000 ahead of the January 15 CPI release would have created an ideal setup for a recovery. Impact of FOMC Meeting and Fed Policies The FOMC meeting, scheduled for January 29 , is an important event for financial markets. It marks the first interest rate decision of 2025 and is being closely watched by investors, particularly in the cryptocurrency space. Last month, Federal Reserve Chair Jerome Powell hinted that there might be fewer interest rate cuts than originally expected, which could put downward pressure on riskier assets like Bitcoin. Adding to the uncertainty, the CME FedWatch Tool indicates a 38.3% probability that the Federal Reserve will hold rates steady in the first half of 2025, which suggests that market participants are anticipating a more cautious stance from the Fed. Cautious Outlook for Bitcoin Despite the potential for a breakout, Thielen remains cautious about Bitcoin’s price in the near term. He predicts that Bitcoin may remain in a range-bound market until mid-March due to weak market drivers and upcoming political events. As Donald Trump’s inauguration on January 20 approaches, analysts are watching for any political developments that could impact Bitcoin’s movement.