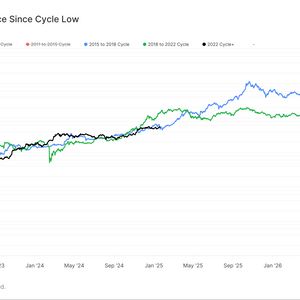

Investment firm Osprey Funds has announced its intention to transform its Osprey Bitcoin Trust (OBTC) into a Bitcoin exchange-traded fund (ETF), following the collapse of a proposed acquisition by Bitwise Asset Management. Osprey revealed in a January 14 statement that it plans to file a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) “as soon as practicable.” The decision comes after the acquisition deal, initially unveiled in August 2024, fell through due to a failure to secure all necessary regulatory approvals by the December 31 deadline. This setback has redirected Osprey’s focus toward the competitive Bitcoin ETF market, an area experiencing significant growth with the SEC’s approval of Hashdex and Franklin Templeton Bitcoin and Ether index ETFs in late 2024. OBTC Eyes ETF Conversion Osprey’s OBTC was once a rival to Grayscale Bitcoin Trust (GBTC), which converted into a spot Bitcoin ETF in January 2024. Currently, OBTC tracks Bitcoin prices without holding the underlying asset and boasts $181 million in assets under management (AUM). Despite OBTC’s 151% growth in unit price over the past year, it remains below its 2021 peak of $50 per unit. As of the last trading session, OBTC’s price closed at $29.84, up 3% on the day, according to Google Finance. The market for Bitcoin ETFs is becoming increasingly crowded, with 32 Bitcoin ETFs now trading in the U.S., 11 of which are spot Bitcoin ETFs. Osprey’s move to convert OBTC into an ETF highlights its determination to remain relevant in a landscape dominated by established players like Grayscale. A Legal Battle and Strategic Pivot In January 2023, Osprey filed a lawsuit against Grayscale , accusing the asset manager of misleading marketing practices that allegedly gave it an unfair advantage in the Bitcoin OTC trust market. That legal dispute remains unresolved. In March 2024, Osprey acknowledged challenges with OBTC units trading at a discount to Bitcoin’s value, sparking discussions about a potential sale or liquidation of the trust. The post Osprey Funds Plans OBTC Conversion to Bitcoin ETF After Acquisition Deal Collapses appeared first on TheCoinrise.com .