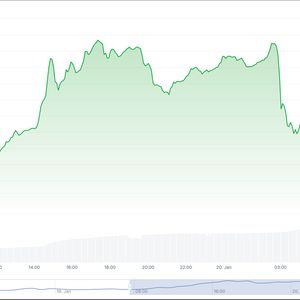

MicroStrategy’s Michael Saylor has hinted at another Bitcoin acquisition in a cryptic tweet that also seemingly references President-elect Donald Trump’s inauguration. “Things will be different tomorrow,” Saylor tweeted Sunday. The statement comes on the heels of MicroStrategy upping its Bitcoin ( BTC ) holdings to 450,000. Things will be different tomorrow. pic.twitter.com/8Rmn1Jjgdr — Michael Saylor⚡️ (@saylor) January 19, 2025 Fred Thiel, CEO of Bitcoin mining company MARA Holdings, and his Vice President of Investor Relations Robert Samuels share a similar sentiment. The pair posed for a picture with Saylor at the so-called “Crypto Ball” on Jan. 17, an event meant to commemorate the return of Trump, now a crypto convert , to the White House. “Our team in partnership with [Saylor] met with the entire incoming cabinet of the Trump Administration. We are excited about the future of mining in the US,” Samuels said. Will MicroStrategy add to its coffers? The tweet, accompanied by a screenshot from Saylortracker , a platform that monitors MicroStrategy’s Bitcoin purchases, carries particular weight given Saylor’s recent pattern. His last such hint on Jan. 12 was followed by a purchase the next day of 2,530 BTC at an average price of $95,972 for $243 million. You might also like: US will not approve strategic Bitcoin reserve: CryptoQuant CEO And with Trump expected to make crypto-friendly executive orders , MicroStrategy’s Bitcoin purchase strategy will likely bode well for the software strategy firm. So far, the Tysons Corner, Virginia-based firm inked several purchases since December 2024: January 13: 2,530 BTC at $95,972 ($243 million) January 6: 1,070 BTC at $94,004 ($101 million) December 30: 2,138 BTC at $97,837 ($209 million) December 23: 5,262 BTC at $106,662 ($561 million) December 16: 15,350 BTC at $100,386 ($1.5 billion) December 9: 21,550 BTC at $98,783 ($2.1 billion) December 2: 15,400 BTC at $95,976 ($1.5 billion) The company’s Bitcoin portfolio has generated an unrealized 67.7% return on investment, representing paper profits of $19.09 billion. At last check on Sunday, Bitcoin is currently trading at over $106,000. See below. Source: CoinGecko If Saylor’s hint turns into another purchase, it would further strengthen MicroStrategy’s position as the largest corporate holder of Bitcoin. The company’s aggressive acquisition strategy has proven particularly profitable in recent months, with most purchases since December showing positive returns ranging from 7.35% to 11.18%. This potential new purchase would follow MicroStrategy’s stated goal of continuing to acquire Bitcoin as part of its corporate treasury strategy. Read more: TRUMP meme coin pushes Solana DEX volume, SOL price to all-time high