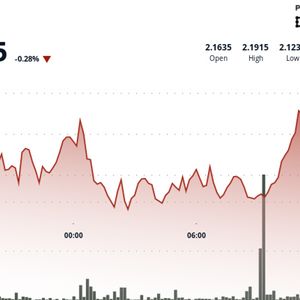

Buckle up, folks! The Eurozone just hit a speed bump, and it’s sending ripples through the forex market. The Euro is currently experiencing a noticeable dip, and the culprit? Recent remarks from the European Central Bank (ECB) President Christine Lagarde regarding potential growth reduction. For those of you tracking the pulse of global finance, this is more than just a blip on the radar – it’s a significant tremor that could have far-reaching consequences. Let’s dive deep into what’s happening and what it means for you. Decoding the ECB’s Growth Reduction Forecast: What’s the Fuss About? So, what exactly did the ECB President say that caused this stir? In recent statements, Christine Lagarde hinted at a possible downward revision of the Eurozone’s growth forecasts. This isn’t just economic jargon; it translates to a potentially slower pace of economic expansion in the region. Why is this significant? Investor Sentiment: Financial markets thrive on optimism and growth prospects. When a major central bank like the ECB signals a potential slowdown, it can dampen investor sentiment. This often leads to investors becoming more risk-averse, and in the forex market, this can translate to selling off currencies perceived as being tied to weaker growth prospects – in this case, the Euro. Economic Outlook: Growth reduction isn’t just a number; it reflects real-world economic conditions. It could mean businesses scaling back investments, slower job creation, and potentially reduced consumer spending. These are all factors that can weigh down a currency’s value. Interest Rate Expectations: Central bank forecasts about growth heavily influence expectations about future interest rate policies. Slower growth might lead to expectations that the ECB will be less aggressive in raising interest rates, or even consider cutting them down the line to stimulate the economy. Lower interest rate expectations generally make a currency less attractive to investors seeking yield, contributing to its depreciation. In essence, the ECB’s cautious outlook on growth has acted as a **powerful** signal to the market, prompting a reassessment of the Euro’s strength. The Domino Effect: How Growth Reduction Triggers a Euro Dip in the Forex Market Now, let’s connect the dots between growth reduction forecasts and the immediate dip in the Euro in the forex market . The forex market is a complex ecosystem where currencies are constantly traded based on a multitude of factors, and expectations play a massive role. Here’s how the ECB’s remarks triggered the Euro’s recent slide: 1. Immediate Market Reaction: News of potential growth reduction is digested by sophisticated algorithms and human traders in milliseconds. The initial reaction is often instinctive – sell the currency associated with weaker growth. This is precisely what we witnessed with the Euro. 2. Flight to Safety: In times of economic uncertainty, investors often seek refuge in perceived ‘safe-haven’ currencies or assets. A weaker Eurozone growth outlook might lead some investors to shift funds to currencies like the US Dollar or the Swiss Franc, further exacerbating the Euro’s decline. 3. Speculative Positioning: Forex markets are also driven by speculation. Traders attempt to anticipate future currency movements and position themselves to profit. ECB’s comments might have encouraged speculative bets against the Euro, adding downward pressure. 4. Algorithmic Trading: A significant portion of forex trading is now automated. Algorithms are programmed to react to specific keywords and economic indicators. Mentions of “growth reduction” or “economic slowdown” from a central bank are likely to trigger automated sell orders for the related currency. 5. Reduced Demand for Euro Assets: A weaker growth outlook can diminish the attractiveness of Eurozone assets, such as stocks and bonds. Foreign investors might reduce their exposure to these assets, leading to less demand for the Euro to purchase them. Think of it like this: imagine a company announcing lower than expected earnings. Investors would likely sell off the company’s stock, causing its price to drop. Similarly, when the ECB hints at weaker Eurozone growth, the ‘price’ of the Euro in the forex market tends to fall. Interest Rates in the Spotlight: The Link to Euro’s Trajectory The dance between interest rates and currency values is a fundamental aspect of forex trading. Central bank interest rate decisions are crucial determinants of currency strength. How does the ECB’s growth outlook tie into interest rates and the Euro’s recent dip? Current ECB Stance: The ECB, like many other central banks, has been in a tightening cycle, raising interest rates to combat inflation. Higher interest rates generally attract foreign investment, boosting demand for a currency. Growth Concerns and Rate Hike Expectations: However, if the ECB is concerned about growth reduction, it might become less inclined to aggressively raise interest rates further. Or, in a more extreme scenario, if the economic outlook deteriorates significantly, the ECB might even consider pausing rate hikes or eventually cutting rates. Impact on Euro’s Appeal: If the market anticipates a less hawkish (less interest-rate-hiking) ECB, the Euro becomes less attractive to yield-seeking investors. Investors might prefer currencies from countries with central banks expected to maintain or increase interest rates more aggressively. This reduced appeal can contribute to the Euro’s depreciation. Future Rate Path Uncertainty: The ECB’s growth concerns introduce uncertainty about the future path of interest rates. This uncertainty itself can weigh on the Euro. Forex markets dislike ambiguity, and when the future direction of interest rates becomes less clear, it can lead to volatility and potentially downward pressure on the currency. Essentially, the market is now trying to gauge how the ECB will balance its fight against inflation with the emerging risks to economic growth. The more the market believes that growth concerns will limit the ECB’s ability to raise interest rates, the more pressure the Euro is likely to face. Navigating the Forex Market Turbulence: Key Considerations The current situation in the forex market surrounding the Euro and ECB remarks presents both challenges and opportunities. Whether you’re a seasoned trader or just keeping an eye on economic developments, here are some key considerations: Stay Informed: Keep a close watch on ECB communications, economic data releases from the Eurozone, and global economic trends. Market sentiment can shift rapidly based on new information. Risk Management is Crucial: Volatility in the forex market can increase during periods of economic uncertainty. Employ robust risk management strategies, including setting stop-loss orders and managing position sizes. Diversification: Avoid over-exposure to any single currency. Diversifying your portfolio across different currencies and asset classes can help mitigate risk. Understand Market Sentiment: Pay attention to market sentiment indicators and news flow. Market psychology can play a significant role in short-term currency movements. Consider Professional Advice: If you’re unsure about navigating the complexities of the forex market, consider seeking guidance from a qualified financial advisor. Remember, forex markets are dynamic and influenced by a multitude of factors. Understanding the underlying drivers, such as central bank policies and economic growth prospects, is essential for making informed decisions. The Broader Economic Landscape: Eurozone Growth and Global Implications The potential growth reduction in the Eurozone isn’t just a regional issue; it has implications for the broader global economy. The Eurozone is a major economic bloc, and its performance can influence global trade, investment flows, and overall economic sentiment. Global Trade Impact: A slowdown in the Eurozone economy could reduce demand for imports from other countries, potentially impacting global trade flows. Countries that rely heavily on exports to the Eurozone might feel the pinch. Investor Confidence: Economic weakness in a major region like the Eurozone can dent global investor confidence. This can lead to increased risk aversion and potentially affect other markets, including emerging economies. Currency Cross-Rates: The Euro’s movements in the forex market influence other currency pairs. For instance, a weaker Euro against the US Dollar can have ripple effects on other currency crosses, impacting trading strategies and global currency dynamics. Policy Responses: The ECB’s actions in response to growth concerns will be closely watched by other central banks globally. Their policy decisions can have a cascading effect on global monetary policy and financial markets. In an interconnected global economy, developments in the Eurozone, especially concerning growth, resonate far beyond its borders. Monitoring these trends is crucial for understanding the broader economic landscape. The Future of the Euro: Navigating Uncertainty The Euro’s recent dip following the ECB President’s remarks underscores the inherent uncertainty in the forex market and the global economic outlook. What does the future hold for the Euro? Dependence on Economic Data: The Euro’s trajectory in the coming weeks and months will heavily depend on incoming economic data from the Eurozone. Key indicators like inflation, GDP growth, employment figures, and business sentiment will provide crucial clues about the actual extent of the growth slowdown and the ECB’s likely response. ECB Policy Communication: The ECB’s future policy statements and press conferences will be closely scrutinized by the market. Clarity and consistency in communication are essential for managing market expectations and reducing volatility. Global Economic Factors: External factors, such as the global energy crisis, geopolitical tensions, and the pace of growth in other major economies, will also play a significant role in shaping the Euro’s outlook. Potential for Rebound: It’s important to remember that currency markets are cyclical. If economic data from the Eurozone turns out to be more resilient than currently feared, or if the ECB manages to effectively address growth concerns, the Euro could potentially rebound. In conclusion, the Euro’s recent dip serves as a reminder of the constant flux in the forex market and the sensitivity of currencies to economic news and central bank signals. Staying informed, managing risk, and understanding the broader economic context are key to navigating these turbulent times. To learn more about the latest Forex market trends, explore our article on key developments shaping currency valuations and trading strategies.