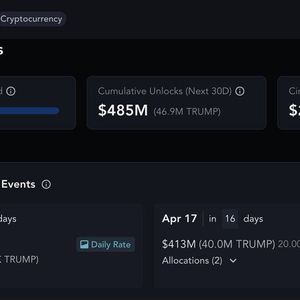

Summary Despite recent market turmoil, Coinbase's valuation has dropped significantly, making it a compelling dip to buy. I'm upgrading the stock to a buy rating. Altcoin prices have shown resilience relative to Bitcoin's sharper drop, which may mean Coinbase's trading revenue won't fall as much as feared. Continued innovation, such as Coinbase One Premium at $300/month and Bitcoin-backed loans, is driving growth in non-transactional recurring revenue streams. Coinbase has also fallen to a very attractive ~9x forward adjusted EBITDA multiple, quite a modest valuation for such a high-growth company. Just a few months ago, the sentiment around Coinbase ( COIN ) and the crypto industry immediately after Trump’s re-election was all euphoria. Crypto investors cheered Trump’s embrace of crypto and promise to make the U.S. the “world capital of crypto,” alongside more friendly regulatory expectations and the establishment of a U.S. crypto reserve. All of these promises still hold. And yet, Bitcoin has tumbled ~20% from peaks, magnifying losses in the S&P 500 and defying the traditional logic that crypto should be a low-correlation asset that can be used as a market hedge, like gold. And against that backdrop, Coinbase has lost 30% of its value since the start of January. Data by YCharts In my view, this is a good juncture for investors to re-assess the bull case for Coinbase. I last wrote a neutral opinion on the stock in January , when Coinbase was still trading near $260. Today, with the stock more than 30% lower, I believe the recent sharp drop has more than compensated Coinbase for any added risk from the recent market turmoil. Though long on the sidelines for this stock due in large part to valuation concerns, I’m much more bullish on Coinbase at its lower prices. As such, I’m upgrading the stock to a buy rating. To me, all the structural and regulatory factors that drove the post-election surge, such as the establishment of a federal crypto reserve, still hold - and we don’t rehash those long-term drivers here. We’ll focus instead on what makes Coinbase a good buy on the dip, based on what has recently changed for the company: relative stability of altcoin prices (relative to BTC), continued innovation that will help to boost Coinbase’s more reliable subscription/services revenue stream, and a more benign valuation. Let’s now go through each of these factors in turn. Q4 trading revenue was on fire; Q1 won’t be bad as feared For investors who are newer to Coinbase, note that the company generates revenue across two distinct streams. Roughly 70% of Coinbase’s revenue derives from the spreads it earns on facilitating trading, while the remaining 30% is a more reliable stream of revenue from subscription fees, mining rewards, custodial fees, and interest. We’ll focus first on the trading portion, which, needless to say, enjoyed a huge burst of activity in the post-election period. In the most recently reported quarter, Q4, Coinbase reported $1.56 billion of transactional revenue, up roughly 3x y/y. Coinbase Q4 results (Coinbase Q4 shareholder letter) Needless to say, this is the lion’s share of the company’s revenue, and given the strict volatility and unpredictability of this activity, Coinbase explicitly does not provide any guidance for this revenue line - it only provides an outlook for subscription/services revenue as well as its expense ratios. Coinbase’s sharp ~30% fall since the start of the year is a reflection of investors’ fear that the pullback in crypto markets (and in risk-taking in general) will dent the company’s recent blazing growth trends. And while it’s true that growth rates will likely decelerate meaningfully from the 194% y/y that the company achieved in Q4, it’s likely to be better than feared. First - in the company’s Q4 shareholder letter, the company noted that it already earned “approximately $750 million” in trading revenue through February 11, or 42 trading days of the 88-day quarter. Of course, trading is volatile, and market losses picked up in late February - but if we do a simple extrapolation of February trends through the remainder of the quarter, we’d get anywhere from $1.5-$1.6 billion in revenue for the quarter, roughly ~40-50% growth versus $1.08 billion in the prior-year Q1. In other words, recent trends through mid-quarter are still pointing to shape double-digit y/y growth rates in trading revenue. Second: it’s important to note that while the large and best-known coins like Bitcoin and Ethereum make up the lion’s share of trading activity on the platform, they’re not the biggest chunk of revenue. Coinbase actually makes higher spreads on smaller altcoins. See the chart below: for the full year FY24, 57% of Coinbase’s revenue came from “other crypto assets” (not specifically defined as BTC, ETH, or XRP), versus just a 43% share of trading volume. Coinbase trading share by type and coin (Coinbase Q4 shareholder letter) Why this is important is because in the recent correction, it appears that the largest altcoins have had relatively better price stability than Bitcoin. At the time of writing, Bitcoin is down ~20% from peaks at $103k. Ethereum is down more than 50% from December peaks, just shy of $4k. Meanwhile, Ripple (XRP) which in the fourth quarter grew to a 14% share of Coinbase’s trading revenue (a bit over half of Bitcoin’s share, and generating more revenue than Ethereum), is actually flat to where it started the year, though down from February peaks in the high $2s. XRP price chart ( CoinMarketCap ) BNB (the 5th largest coin with a ~$90 billion market cap) is only down ~10% from December/January levels in the high $600s. BNB price chart ( CoinMarketCap ) The point here is that, by and large, it seems that crypto assets outside of Bitcoin have enjoyed greater price stability in this downturn - and since these are the coins that generate wider spreads for Coinbase, the company’s trading revenue growth might not drop as sharply as feared. Continued innovation is driving subscription fees Beyond the hope of continued growth in trading revenue, we also like the fact that Coinbase continues to develop its capabilities to continue growing its non-transactional recurring revenue base. One major initiative is Coinbase One, the company’s subscription membership. Over the past year, Coinbase has introduced the premium membership in more countries, which has helped the company’s international revenue contribution climb to 19% in Q4, up 3 points y/y. Though it doesn’t provide regular subscriber metrics each quarter, the company notes that it has passed the 600k subscriber mark, up “more than 50%” since Q1 of 2024. The final y also recently unveiled a new Coinbase One Premium tier, priced at a hefty $300/month and giving users access to unlimited zero trading fees and richer USDC wallet rewards. This is an offering that caters to true crypto professional traders. Rewards for holding USDC are also new, giving users more incentive to purchase and hold the USD-backed stablecoin (while Coinbase earns lucrative interest spreads on funds held). Coinbase also recently released loans backed by Bitcoin, which is an innovative application of blockchain technology. Bitcoin holders now also have the opportunity to “leverage” their bitcoins held in Coinbase and receive U.S. dollar-based loans, allowing them to access liquidity without selling their holdings and triggering capital gains. The company also continues to step up its offerings for institutional clients, which have increasingly waded into the crypto markets and following the new administration’s direction that crypto will be favorably looked upon and regulated. Institutional volumes more than doubled y/y in Q4. Per CFO Alesia Hess’s remarks on the Q4 earnings call: Our institutional trading volume was $345 billion, up 128%, also outperforming the U.S. spot market. Institutional transaction revenue was $141 million, up 156%. In the fourth quarter, we saw strong adoption of the Prime product suite. Across custody, trading, financing, and staking, our top clients are engaged with most of these products in 2024, and our onboarding pipeline remains robust. Our Prime financing product had all-time high loan balances in the fourth quarter in connection with the strong market conditions, and we see elevated trading amongst clients who are using financing.” In my view, all of these moves (especially the rollout of a professional-tier Coinbase One subscription) will help to diversify Coinbase’s revenue into steadier streams that reduce its dependence on volatile consumer trading. Valuation, risks, and key takeaways The biggest impetus to buy Coinbase now, however, is the fact that its valuation finally appears to have fallen to very reasonable levels. At current share prices near $174, Coinbase trades at a $44.16 billion market cap. After we net off the $9.82 billion of cash, cash equivalents, and USDC on Coinbase’s most recent balance sheet (and not counting ~$1.55 billion of other crypto assets held for investment) against $4.23 billion in debt, Coinbase’s resulting enterprise value is $38.57 billion. For FY25, Wall Street is currently expecting Coinbase to generate $8.12 billion in revenue, or 24% y/y growth. If we assume a 51% adjusted EBITDA margin on this revenue profile (a conservative assumption of flat margins to FY24), adjusted EBITDA would be $4.14 billion (+24% y/y). This puts Coinbase’s valuation multiples at: 4.8x EV/FY25 revenue 9.3x EV/FY25 adjusted EBITDA To me, a single-digit EBITDA multiple for a company that is on track to sustain double-digit growth in revenue this year, with plenty of secular tailwind for greater crypto adoption (particularly by institutions) is quite compelling. Of course, there are risks we need to keep in mind. The crypto community has long embraced a buy-and-hold (or “hodl”) mentality during downturns. Despite my earlier assertion that altcoins’ price has dipped more modestly compared to bitcoin, the nervous market environment overall could persuade more crypto owners to simply hold their positions rather than trade, reducing trading volumes and Coinbase’s revenue. This being said, however, I like the continued expansion of Coinbase’s non-trading revenue streams, and to me, risks are already more than embedded into the stock’s currently discounted price. Buy the dip here.