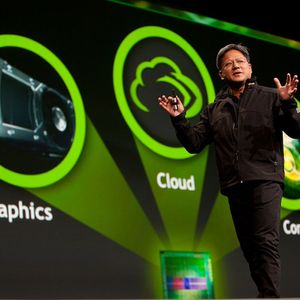

Exciting news for the tech world! Nvidia, a giant in the chip industry, is making a groundbreaking move to significantly boost AI chips US manufacturing . For those in the cryptocurrency space, this signifies a major leap in the infrastructure that powers many blockchain and AI-driven crypto projects. Imagine faster, more efficient AI processing right here in the United States – that’s the future Nvidia is building. Let’s dive into what this means for the tech landscape and beyond. Why is Nvidia Boosting AI Chips US Manufacturing? Nvidia’s announcement to manufacture AI chips US manufacturing marks a pivotal shift towards strengthening domestic technology production. The company has committed to over a million square feet of manufacturing space across Arizona and Texas. This isn’t just about expanding production; it’s a strategic play to: Meet Exploding Demand: The demand for Nvidia AI chips is skyrocketing, fueled by the AI boom. Manufacturing in the US helps Nvidia keep pace with this incredible growth. Strengthen Supply Chains: Global supply chain disruptions have highlighted vulnerabilities. By increasing US chip production , Nvidia is building a more resilient and secure supply chain. Boost Resiliency: Domestic production reduces reliance on overseas manufacturing, enhancing Nvidia’s ability to weather geopolitical uncertainties and market fluctuations. Support American Innovation: Manufacturing AI chips US manufacturing locally fosters innovation and job creation within the United States. This strategic decision underscores the importance of localized production in a world increasingly reliant on advanced technologies like AI. Blackwell AI Chips: The Powerhouse of US Production At the heart of this US chip production expansion are Nvidia’s cutting-edge Blackwell AI chips . These powerful processors have already begun production at TSMC’s Phoenix, Arizona plants. What makes Blackwell chips so significant? Unmatched Performance: Blackwell chips are designed to deliver unprecedented performance for AI workloads, pushing the boundaries of what’s possible in machine learning and deep learning. TSMC Partnership: Collaborating with TSMC in Arizona ensures access to advanced manufacturing processes and expertise. Rapid Production Ramp-Up: Mass production of Blackwell AI chips in Arizona and Texas is expected to accelerate within the next 12-15 months, promising a significant influx of these high-performance chips. The Blackwell series is set to become the workhorse of the new wave of AI infrastructure US production. Building a US AI Infrastructure Powerhouse Nvidia isn’t just building chip plants; they are constructing “supercomputer” manufacturing plants in Texas, partnering with industry giants like Foxconn in Houston and Wistron in Dallas. This initiative is about creating a comprehensive AI infrastructure US ecosystem. Key aspects include: Massive Investment: Nvidia aims to produce up to half a trillion dollars worth of AI infrastructure US within the next four years. This represents a colossal investment in American technology and manufacturing. Strategic Partnerships: Collaborations with Foxconn, Wistron, Amkor, and SPIL bring together leading expertise in manufacturing, packaging, and testing, ensuring a robust and efficient production process. End-to-End US Ecosystem: From chip fabrication to packaging and testing, Nvidia is establishing a complete domestic supply chain for AI infrastructure US . This ambitious undertaking signals a new era for US technological independence and leadership in the AI domain. What are the Potential Challenges? While Nvidia’s move is undeniably positive, scaling up AI chips US manufacturing on this scale will not be without its challenges: Skilled Workforce: Ramping up production requires a skilled workforce. Training and recruiting talent in semiconductor manufacturing and AI technologies will be crucial. Infrastructure Costs: Building and maintaining advanced manufacturing facilities is a significant financial undertaking. Managing costs effectively will be essential. Global Competition: The global semiconductor landscape is highly competitive. Nvidia will need to navigate international competition and evolving market dynamics. Technological Advancements: The pace of innovation in AI and chip technology is rapid. Continuous investment in R&D and adaptation to new technologies will be vital for sustained success. Overcoming these hurdles will be key to realizing the full potential of AI chips US manufacturing . The Future is Made in America Nvidia’s bold initiative to ramp up AI chips US manufacturing is more than just a business decision; it’s a statement about the future of technology and American innovation. As Jensen Huang, Nvidia CEO, aptly stated, “The engines of the world’s AI infrastructure are being built in the United States for the first time.” This move promises to: Drive Economic Growth: Creating jobs and fostering technological advancement within the US. Enhance National Security: Securing domestic access to critical AI technologies. Accelerate AI Innovation: Providing a robust infrastructure to support the next wave of AI breakthroughs. For the crypto and tech communities, this development signifies a stronger, more resilient foundation for future growth and innovation, powered by AI infrastructure US . To learn more about the latest AI market trends, explore our article on key developments shaping AI features .