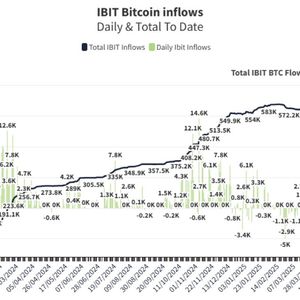

Cryptocurrency prices have pulled back this week as market attention shifts to Wednesday’s Federal Reserve interest rate decision. Bitcoin ( BTC ) has pulled back from last week’s high of $97,000 to $93,700, while Ethereum ( ETH ) remains below the $2,000 level. The total market capitalization of all cryptocurrencies has slipped to $2.9 trillion, with the crypto fear and greed index stuck at a neutral point. On the positive side, assets in spot Bitcoin ETFs have surged by $5 billion in the last two weeks, signaling that there is still demand from institutional investors. Another positive is that analysts and Polymarket traders anticipate the Fed will cut interest rates three times this year. A more dovish Fed is bullish for Bitcoin and other altcoins. Best crypto to buy now as BTC ETF inflows rise Some of the top cryptocurrencies to buy now are Polkadot ( DOT ), Chainlink ( LINK ), Uniswap ( UNI ), and Sonic ( S ). Polkadot Polkadot is one of the top contrarian cryptos to buy now as its price hovers near its all-time low. The most bullish factor is that it has found strong support at $3.82, a level it has failed to break below several times since 2023. This is a sign that it has formed a quadruple-bottom pattern with a neckline at $11.57. DOT has also formed the harmonic XABCD pattern and is now starting the final CD wave. If this pattern plays out, the coin will likely rebound and retest the key resistance point at $12, up by almost 200% from the current level. Polkadot also has a high staking yield of 11.5%, has high chances of seeing a spot DOT ETF , and is implementing the final stage of Polkadot 2.0 transition. DOT price chart | Source: crypto.news You might also like: Polkadot price could surge as development activity soars Chainlink Chainlink is another top altcoin to buy because of its strong technicals and fundamentals. Fundamentally, it is the biggest oracle network in the crypto industry, connecting off-chain data to the blockchain. Its Cross-Chain Interoperability Protocol is also the leading standard in the Real World Asset tokenization industry. The daily chart shows that LINK has formed a falling wedge pattern, a popular bullish reversal signal. It is also slowly forming an inverse head and shoulders pattern, with the current retreat being part of the right shoulder. Therefore, the coin will likely drop further for a while and then resume its bullish trend. LINK price chart | Source: crypto.news Uniswap Uniswap, the biggest decentralized exchange in crypto, is a top crypto to buy after falling 74% from its highest level in November last year. The main reasons for buying it are mostly fundamental. It is the biggest player in the DEX industry by far. It handled over $51 billion worth of transactions in the last 30 days, more than PancakeSwap’s $30 billion. Uniswap also launched Unichain , a layer-2 network that has become highly successful. Protocols in the network handled over $4.2 billion in assets in the last 30 days, flipping popular layer-1 networks like Avalanche and Cronos. Sonic Sonic, formerly known as Fantom, has become one of the fastest-growing chains in the industry. It has attracted over 69 dApps in its ecosystem, with a total value locked of over $1 billion . Its DEX networks have handled over $784 million in the last seven days, making it the 11th biggest chain in the industry. There is a likelihood that its token will bounce back in the coming weeks since it has formed an inverse head and shoulders pattern on the four-hour chart. You might also like: Casper 2.0 launches on the mainnet, with a real world asset focus