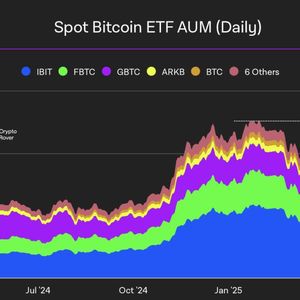

The post Bitcoin and Altcoins Breakout Alert: Trade War Eases as China, US Cut Tariffs appeared first on Coinpedia Fintech News In a big development for global markets, China has announced it will lower tariffs on U.S. goods from 125% to 10%, while the U.S. will cut its tariffs on Chinese products from 145% to 30%. These reduced tariffs will remain in effect for the next 90 days, giving both nations a window for further trade negotiations. While global equities and commodities welcomed the move, the crypto market showed only a mild reaction. Bitcoin, however, continued to hold above the crucial $104,000 level and is inching closer to the $105,000 mark. Analysts said that Bitcoin had already begun rallying ahead of this announcement, and this news could serve as fuel for the next upward leg. BREAKING: China will lower tariffs on U.S. goods to 10% from 125% USA will cut tariffs on Chinese goods to 30% from 145% The measures will be in place for 90 days to allow for more trade negotiations. pic.twitter.com/TK0S9LTG2h — Visegrád 24 (@visegrad24) May 12, 2025 According to an analyst, Bitcoin is currently around day 915 of its typical 1,100-day bull market cycle. Historically, the biggest gains tend to occur between days 1,000 and 1,100, meaning we could be on the brink of a parabolic move if past patterns hold true. Bitcoin’s weekly MACD has flipped green — a historically bullish signal. The last time this happened was in Q4 2024, shortly before Bitcoin surged higher. Additionally, the weekly RSI remains far from overbought levels, hinting there’s still room for the rally to extend. Bitcoin Dominance Drops, Altcoins Stir Another key development is the ongoing decline in Bitcoin dominance — a sign that traders are rotating capital into altcoins. Memecoins, in particular, are making a comeback. In the last 24 hours alone, some tokens have jumped 10–30%, reminiscent of the explosive memecoin-led rallies of late 2023. The question now is whether these tokens will continue leading the way in this market cycle. Adding to the bullish setup, the U.S. will release its CPI inflation data tomorrow, a key event that could sway both equity and crypto markets. Meanwhile, U.S. Vice President JD Vance is scheduled to speak at a major Bitcoin conference.