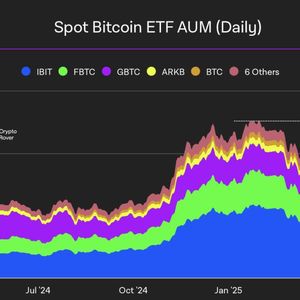

The world of cryptocurrency is constantly evolving, and political landscapes are increasingly reflecting this shift. In a significant development for the digital asset space, especially within East Asia, a prominent figure in South Korean politics has thrown his support behind a move long awaited by many investors: the introduction of spot crypto exchange-traded funds (ETFs). South Korea Crypto Policy Takes Center Stage in Election As South Korea gears up for its 21st presidential election, the topic of digital assets is unexpectedly taking a central role in policy discussions. Traditionally, economic policies might focus on traditional markets, housing, or employment, but the growing influence and adoption of cryptocurrencies have brought them into the political spotlight. This election cycle appears to be one where candidates are recognizing the significant portion of the electorate involved in or interested in the crypto market. The pledge by Kim Moon-soo, a presidential candidate representing the People Power Party (PPP), highlights a potential shift in the official stance towards digital assets. His inclusion of allowing spot crypto ETFs within his top 10 policy promises signals a strategic move to appeal to a demographic increasingly invested in this new asset class. This focus on crypto policy suggests that politicians are beginning to view digital assets not just as a fringe topic, but as a legitimate area for economic policy development. Spot Crypto ETFs South Korea: The Core Pledge The most impactful part of Kim Moon-soo’s announcement is his clear commitment to enabling spot crypto ETFs in South Korea. For those unfamiliar, a spot crypto ETF is an investment fund that directly holds the underlying cryptocurrency (like Bitcoin or Ethereum) as opposed to futures contracts or other derivatives. These ETFs are designed to track the real-time price of the cryptocurrency, offering investors a more direct exposure without the complexities of buying and storing the digital assets themselves. Why is this significant for Spot crypto ETFs South Korea? Accessibility: ETFs trade on traditional stock exchanges, making it easier for retail and institutional investors to gain exposure to crypto through familiar brokerage accounts. Regulation & Oversight: ETFs are subject to regulatory oversight, potentially offering a layer of investor protection that individual crypto exchanges might not always provide. Institutional Capital: Spot ETFs can attract significant institutional investment, which has historically been hesitant to directly hold cryptocurrencies due to regulatory and custodial concerns. Market Legitimacy: The approval of spot ETFs by regulatory bodies is often seen as a sign of legitimacy and maturity for the underlying asset class. This pledge directly addresses a key barrier for many potential investors and could significantly broaden participation in the Korean crypto market. What This Means for the Korean Crypto Market The potential introduction of spot crypto ETFs could have a transformative effect on the Korean crypto market. South Korea already has a highly active and tech-savvy population with a significant interest in digital assets. However, regulatory uncertainties have sometimes created hurdles for both investors and businesses in the space. The approval of spot ETFs could lead to: Increased Liquidity: More accessible investment vehicles typically lead to higher trading volumes and market depth. Price Impact: Increased demand from both retail and institutional investors flowing through ETFs could potentially have a positive impact on the prices of the underlying cryptocurrencies traded in the Korean market. Innovation: A more favorable regulatory environment signaled by ETF approval could encourage further innovation in the Korean blockchain and crypto sector. Global Standing: Becoming one of the first major economies in Asia to approve spot crypto ETFs could bolster South Korea’s position as a leader in the digital asset space. Kim Moon-soo frames this pledge within a broader campaign theme focused on enhancing middle-class asset growth. By making crypto investment more accessible and potentially safer through regulated products like ETFs, he aims to provide new avenues for citizens to build wealth in what he describes as a nation of opportunity. This explicitly links digital asset policy to traditional economic goals. Korean Presidential Candidate Crypto Stance Explained Kim Moon-soo’s stance on crypto is not entirely new. His current pledge builds upon previous ideas he has floated regarding digital assets. During an earlier primary race within the People Power Party, he proposed the creation of a dedicated digital asset secretary within the presidential office. This earlier proposal indicates a consistent belief that digital assets require focused attention at the highest levels of government. Having a specific office or secretary dedicated to digital assets could streamline the development of Digital asset regulation Korea, coordinate policy across different ministries, and provide a central point of contact for the industry. This proactive approach suggests the candidate views digital assets as a significant sector requiring dedicated governmental strategy, not just piecemeal regulation. His current policy pledge on spot ETFs is a concrete action point stemming from this broader view. It’s a specific, tangible policy that resonates directly with investors and the crypto industry, making his Korean presidential candidate crypto position clear and actionable. Digital Asset Regulation Korea: A Look Ahead The path to implementing such a policy is not without its challenges. Digital asset regulation Korea has been evolving, with efforts to enhance investor protection and combat illicit activities. Introducing spot crypto ETFs would require careful consideration and likely new frameworks from financial regulators like the Financial Services Commission (FSC). Key regulatory hurdles might include: Custody Rules: Establishing secure and compliant custody solutions for the underlying cryptocurrencies held by the ETFs. Valuation Methods: Defining reliable and transparent methods for valuing the assets within the ETF. Investor Protection: Ensuring adequate safeguards are in place for investors, including clear disclosure requirements. Market Surveillance: Implementing robust systems to monitor trading and prevent market manipulation. The success of implementing this pledge would depend heavily on cooperation between the executive branch, legislative bodies, and financial regulators. While a candidate’s pledge is a strong signal, navigating the regulatory landscape requires significant effort and consensus building. Benefits and Challenges Summary Potential Benefits Potential Challenges Increased investor access and participation Navigating complex regulatory approvals Attraction of institutional capital Ensuring robust custody and security Enhanced market legitimacy and liquidity Developing appropriate valuation standards Alignment with middle-class asset growth goals Protecting investors from potential risks Potential boost to the Korean crypto sector Political opposition or delays This table provides a snapshot of the potential positive outcomes versus the obstacles that would need to be addressed should this policy move forward. Conclusion Kim Moon-soo’s pledge to allow spot crypto ETFs is a significant moment for the Korean crypto market and South Korea crypto policy. By including this specific digital asset policy in his top election promises, he is directly acknowledging the importance of cryptocurrencies to a segment of the population and proposing a concrete step towards integrating digital assets into the mainstream financial system. While the path to implementation involves overcoming regulatory hurdles and gaining broader political support, the fact that a major Korean presidential candidate crypto stance is so explicitly pro-ETF signals a potential turning point for Digital asset regulation Korea and the future of Spot crypto ETFs South Korea. To learn more about the latest crypto market trends, explore our article on key developments shaping the Korean crypto market institutional adoption.