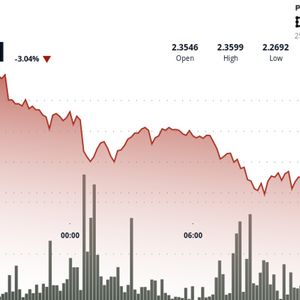

Bitcoin (BTC) registered a dramatic collapse on Friday after President Trump threatened to impose a 50% tariff on all goods imported from the European Union after growing frustration around ongoing trade talks. Trump took to Truth Social to announce the measures and threatened a 25% levy on imported Apple iPhones. As a result, the flagship cryptocurrency plunged to a low of $106,816 before recovering on Saturday and during the ongoing session. Crypto Bulls Lose $500M As Bitcoin (BTC) Plunges Below $110,000 Bullish crypto bets saw investors lose over $500 million after Bitcoin (BTC) tumbled below $110,000 following President Trump’s fresh tariff threats on European imports and overseas Apple products, triggering a wave of liquidations. Bitcoin, which traded above $111,000, quickly slid to around $108,000 following the threats, wiping out gains and disrupting investor sentiment. The broader crypto market mirrored BTC’s decline, with futures tracking Ethereum (ETH), Solana (SOL), Ripple (XRP), and Dogecoin (DOGE) showing losses from $30 million to $100 million. Meanwhile, Bitcoin futures registered losses of around $181 million, while ETH futures registered losses of around $142 million, with altcoins adding another $100 million in liquidations. Large-scale liquidations generally indicate panic selling and a cascade of liquidations could suggest a market turning point and an imminent price reversal. Bitcoin (BTC) Analyst Makes Bold Prediction An analyst has predicted Bitcoin could surge to an astonishing $325,000 peak. The analyst also provided an accelerated timeline for the flagship cryptocurrency to accomplish this feat. The analyst based their prediction on a technical analysis chart spanning BTC’s movements from 2009 to 2025, applying the Elliot Wave Theory on a High Time Frame and tracking a five-wave impulsive structure, with each wave representing a major bullish cycle. The analyst stated that Bitcoin is currently in Wave 5, the last wave of this cycle, suggesting the market is on the verge of a final parabolic price increase. According to the analysis, Bitcoin’s past bull markets have ended with a near-vertical explosive surge, where the price accelerates before entering a corrective phase. The $325,000 price forecast comes with an exceptional near-term timeline. The analyst predicts that Bitcoin could reach this target as early as July 2025, a little over a month away. Bitcoin (BTC) Price Analysis Bitcoin (BTC) is attempting to recover after Friday’s sudden decline, triggered by President Trump threatening to impose 50% tariffs on all goods imported from the European Union. The drop saw BTC plunge to an intraday low of $106,816, leading to the liquidation of $594 million in crypto derivatives. As a result, crypto bulls lost $507 million, while shorts accounted for the remaining $87 million. The pullback occurred despite BTC registering increased institutional interest and increased ETF inflows. Funding rates also signal caution as traders wait on the sidelines. Glassnode data revealed that despite BTC trading above $108,000, funding rates have been relatively muted at 0.0079%. While short-term sentiment indicates caution, on-chain data reveals support emerging at lower levels. According to Glassnode, over 420,000 BTC has a cost basis around the $94,000 level, forming one of the strongest support zones in the cycle. This massive accumulation suggests strong buying interest at this price level. “More than 420K $BTC now have a cost basis around the $94K level, forming one of the strongest support zones in the current cycle. This dense cluster of accumulation has held firm through consolidation in early May - providing the launchpad for #Bitcoin’s breakout to new highs.” BTC started the previous week in the red, dropping 1.04% on Monday before rebounding on Tuesday and settling at $104,123. The price was back in the red on Wednesday, falling 0.53% and settling at $103,568. BTC fell to an intraday low of $101,459 on Thursday but recovered to register a marginal increase and settle at $103,816. Price action was bearish on Friday and Saturday as the price declined marginally to $103,235. However, BTC recovered on Sunday to register an increase of over 3%, cross $106,000 and settle at $106,489. Source: TradingView BTC plunged to an intraday low of $102,135 on Monday as the week got off to a bearish start. The price recovered from this level to reclaim $105,000 and settle at $105,572. Sentiment changed on Tuesday as the price registered an increase of 1.21% and settled at $106,854. Bullish sentiment intensified on Wednesday, with the price rising 2.57% to cross $109,000 and settle at $109,603. BTC surged to a new all-time high on Thursday, rising to $111,917 before settling at $111,582. However, markets turned bearish after President Trump threatened to impose 50% tariffs on goods from the EU. As a result, BTC plunged nearly 4% to $107,356. The price recovered on Saturday, registering a marginal increase and settling at $107,855, but not before reaching an intraday high of $109,567. The current session sees BTC marginally up as it looks to build momentum and reclaim $110,000. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.