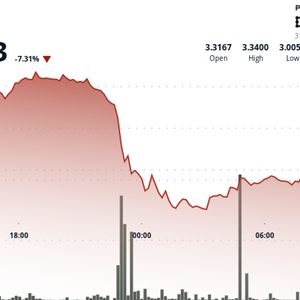

Summary I'm initiating a buy on Trump Media & Technology Group Corp. due to its oversold technical setup and potential for a near-term bounce as sentiment stabilizes. Despite limited fundamentals and high volatility, I see the stock's current price as an attractive entry, especially with support at $19-$20. Trump Media's pivot to Bitcoin and blockchain, while risky, aligns with its core audience and could create new monetization opportunities. Valuation is speculative, but with sentiment so low, I believe a rebound is likely, and I recommend adding during the current weakness. I hereon share my sentiment on DJT stock and why I see more upside ahead. Investment thesis: Technical analysis Trump Media & Technology Group Corp. ( DJT ), President Donald Trump’s media company, has been among the worst-performing stocks after the April dip: the stock is down over 37% year to date, which is precisely why I’m initiating the stock with a buy. Technical factors drive my bullish call; with the stock leaning into oversold territory and recovering from overbought territory earlier this month, I think the stock could run, and this is looking like a nice play for the near-term. The stock also trades below all its moving averages, with EMA21 and EMA50 acting as near-term resistance at $24. I think a break above these EMAs should support a comeback. Still, the $19- $20 levels act as support, and a break below these levels risks retesting the $15 April lows (my worst-case scenario floor). With limited revenue, political uncertainty, and speculations about the latest crypto announcement, I am not betting on the company’s fundamentals just yet. All I’m saying is: the setup is ripe for a bounce as sentiment stabilizes, and investors are best positioned to enter at the current price, or around the next support lines: $19 and $20. Yahoo Finance Like Tesla ( TSLA ), this stock often trades more on hype and headlines than fundamentals, in my opinion, earning a spot as a "meme stock." While the risk of investing in such a stock is high, I think the stock presents an attractive entry point at current levels, especially after investors digest what are now considered negatives for the company. I beg to differ. So why was the stock down around 7% on Wednesday, and what negatives have been priced in? What happened last Tuesday? With Bitcoin (BTC-USD) trading near record highs, the company wants a place at the table and is borrowing a page straight from the MicroStrategy ( MSTR ) playbook, where crypto becomes the business model. Earlier this week, Trump Media announced plans to raise $2.5 billion, a sum it intends to convert into a Bitcoin reserve, from about 50 institutional investors, with $1.5 billion in common shares and $1 billion in convertible senior notes. Where others reinvest in software or platform development, this move places cryptocurrency at the heart of the company’s corporate strategy, further mirroring Trump’s goal to create a “strategic bitcoin reserve” for the U.S. government. Investors got spooked, and everyone and their grandmother turned bearish on the stock after the announcement. I made the MicroStrategy comparison, but things look a bit different for Trump Media. MicroStrategy has decades of enterprise software revenue to fall back on, but Trump Media is still in its early innings, with limited revenue and no profitability in sight. According to the form 10-Q reported in early May, the company “generated limited advertising revenue through Truth Social and no advertising revenue through our newly launched streaming operations, Truth+.” Yes, allocating a large sum to Bitcoin, an extremely volatile asset, could make matters worse and distract from building out core business functions. But I think the market is sleeping on the opportunity ahead. According to the company’s CEO, Devin Nunes, Trump Media views Bitcoin as : “an apex instrument of financial freedom, and now Trump Media will hold cryptocurrency as a crucial part of our assets. Our first acquisition of a crown jewel asset, this investment will help defend our Company against harassment and discrimination by financial institutions.” Trump Media isn’t your typical media company; it’s politically driven and is built on narratives that challenge mainstream institutions. By embracing Bitcoin, the company is aligning itself with themes of financial independence, and through that, it resonates more strongly with its core audience. According to Nunes, the move will help enable crypto-based subscription payments and support the development of a Truth Social utility token (a proprietary digital currency designed for transactions within the platform’s blockchain ecosystem). Call me an optimist, but I think this gives the company a new digital economy to build around, in turn reducing reliance on traditional advertising and monetization, which have both been limited so far, as I mentioned above. Trump and Bitcoin: During his first term, Trump had a completely different sentiment on bitcoin, and called it “not money,” but things have changed drastically since then. During his 2024 presidential campaign, Trump became the first major U.S. candidate to accept crypto donations, and since returning to office, he has launched his own cryptocurrency, the $TRUMP meme coin. Just last week, Trump hosted a dinner at a high-end golf club in Virginia to honor 220 of the token’s top investors, while the top 25 investors enjoyed more special access. While marketed as a gesture of appreciation, the event got backlash from ethics watchdogs, claiming it highlights overlaps between Trump’s public duties and private financial interests. According to U.S . Senators Adam Schiff and Elizabeth Warren in a letter to the Office of Government Ethics, "The American people deserve the unwavering assurance that access to the presidency is not being offered for sale to the highest bidder in exchange for the President's own financial gain.” Valuation and what’s next: Valuation is through the roof, and the recent price movement is indicative of extreme speculation of the company’s latest moves rather than business fundamentals, which continue to struggle regardless. YChart The company has seen a steep valuation reset from the beginning of the year, with shares down nearly 37% so far. The company’s EV/Sales and Price/Book ratios have compressed by 41.7% and 35.4%, respectively, and its Price/Sales ratio has also dropped another 26%. This might seem like the market is “de-risking” the name, but a closer look suggests otherwise, at least in my opinion. Fortunately, the stock trades on momentum, and when sentiment bottoms out like it is now, a comeback is overdue. After repeated efforts to grow the business through more conventional means failed to yield results, Trump Media is now pivoting and embracing Bitcoin and blockchain narratives, something I think the company will reap the fruits of in the long term. Still, with a shift so drastic comes heightened investor scrutiny. Many are asking the question: Is this latest move a strategic breakthrough or just another distraction? I’m choosing to look at the glass half full, and I’m advising investors to add on the current panic.