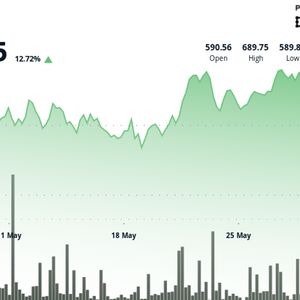

Cryptos SUI , XRP , and ETH are showing promising signs. This summer could see significant price jumps. Key levels have been identified that might spark huge gains. Enthusiasts and investors should keep a close watch on these developments. Get ready to uncover which coins are gearing up for a potential surge. Sui Coin Market Trends Amid Ongoing Bearish Pressure Sui has experienced a notable decline in recent months, dropping by 8.27% in the last month and 3.84% over the past half year. Weekly performance also reflects downward pressure, with a decrease of 10.05%. Price activity has predominantly stayed within a range of $2.77 to $4.01, highlighting ongoing market uncertainty. The coin's movements suggest a gradual retreat from prior highs, showcasing sensitivity to external market conditions and a consistently negative momentum. Currently, Sui trades between $2.77 and $4.01, with immediate support at $2.29 and resistance at $4.77. Bears dominate this phase, as indicated by negative momentum and an RSI value around 40.51, pointing to weak buyer interest. The trend shows uncertainty, fluctuating between selling pressure and brief periods of stabilization. Traders should monitor for potential rebounds near $2.29 or a further drop to around $1.05. Conversely, a breakout above $4.77 could trigger new buying interest towards $6.01, suggesting cautious trading strategies with managed risk amidst persistent bearish sentiment. XRP Moves Lower Amid Continuing Bearish Sentiment XRP experienced a decline over the past month, with prices drifting downward by roughly 2.74% from earlier highs. Over the half-year period, prices fell significantly by nearly 21%, indicating sustained bearish pressure. During the past week, a drop close to 7.53% further signaled volatility and cautious market sentiment. Historical movements reflect a period where selling pressure steadily increased, contributing to a lingering downtrend. Investors faced consistent challenges in pushing prices higher during these recent timeframes. Currently, XRP is trading within a defined range between $1.95 and $2.53. Immediate resistance stands at $2.88, with an additional barrier at $3.45, while support is observed near $1.73 and deeper backing around $1.15. The Relative Strength Index remains around 39.6, suggesting the coin is inching toward oversold levels. The market shows no clear upward trend, with bears dominating. Traders might consider short-term moves by targeting small corrections within these levels, but caution is urged until a decisive break above resistance occurs. Ethereum Shows Short-Term Gains Amidst Long-Term Decline Ethereum ’s price action over the last month reveals a notable rise of 36.21%, contrasting with a broader six-month decline of 31.22%. Price levels have fluctuated significantly, reflecting renewed confidence among buyers in the short run despite a subdued longer-term outlook. Recent activity indicates aggressive buying, which has pushed prices higher, while the overall market sentiment over the past six months has remained cautious. This has resulted in a mix of swift recoveries and gradual declines, creating a volatile environment without a stable pattern. Ethereum is currently trading between $1923 and $2961.93, with resistance around $3395.41 and support at $1318.73. A second resistance level exists at $4433.75, with another support near $280.39. While bulls have driven prices up recently, bears still influence the longer-term trend. The unclear direction suggests a transitional market, urging traders to explore opportunities near support levels for rebounds and monitor resistance points for potential reversals. A balanced approach could lead to better outcomes as the market seeks a more defined pattern. Conclusion SUI , XRP , and ETH are showing potential for strong performance this summer. Hitting key levels could lead to significant gains. SUI is poised for its next move if it can surpass its resistance point. XRP might see a surge if it breaks through its long-standing resistance. ETH holds promise of a rally if it can sustain its upward momentum. Keep an eye on these pivotal points to see how these coins will unfold in the coming months. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.