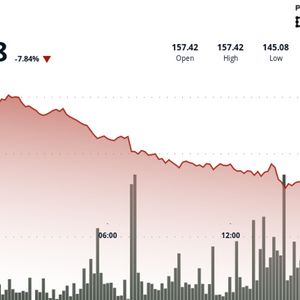

U.S. crypto-linked stocks saw gains across the board on Monday, as Bitcoin prices rebounded and more public companies announced new Bitcoin purchases for their treasuries. The upward trend reflects growing investor confidence in digital assets, particularly among publicly traded firms seeking to leverage Bitcoin as a strategic financial asset. Leading the day’s movement was Nasdaq’s recent entrant, Circle Internet Group (CRCL), which jumped 7% and rose another 2.2% in after-hours trading, closing at $117.79. Major crypto miners followed suit. Core Scientific Inc. (CORZ) rose 4.27%, with a slight 0.87% bump after market close. Competitors CleanSpark Inc. (CLSK) and MARA Holdings Inc. (MARA) each climbed over 3%, with both stocks ticking up another 1% in after-hours activity. Riot Platforms Inc. (RIOT) also added 2.74% during the day, followed by a 1.2% increase after-hours. These gains coincided with Bitcoin’s own 4% surge to $110,150, edging closer to its record high of $112,000 set on May 22. Market sentiment appeared to improve amid reports of U.S.–China trade discussions held in the UK. Mixed Results for Trading Platforms’ Stocks Not all crypto-related stocks enjoyed Monday’s rally. Robinhood Markets Inc. (HOOD) was among the few laggards, falling nearly 2% to $73.40 after being left out of the S&P 500 index during its latest rebalancing. The omission came as a disappointment to investors who had speculated on Robinhood’s inclusion, a move that often brings a boost in share price due to increased institutional interest. In contrast, rival trading platform eToro Group Ltd. (ETOR), which recently went public , surged 10.5% and climbed another 2.4% after hours to $77.79. American crypto exchange giant Coinbase Global Inc. (COIN) posted a modest 2% gain to $256.63, reflecting steady investor support amid the broader market uptrend. Bitcoin Holdings Fuel Investor Confidence Several public firms continue to embrace Bitcoin as a reserve asset. MicroStrategy Inc. (MSTR), already one of the largest corporate holders of Bitcoin, gained 4.71% and added over 1% in after-hours trading to reach $396.61. Meanwhile, BitMine Immersion Technologies Inc. (BMNR) became the latest firm to jump on the Bitcoin bandwagon, announcing the purchase of 100 BTC following an $18 million share offering. Despite the news, BMNR fell 8.7% before slightly rebounding by 5.2% after hours to $7.25. Energy tech company KULR Technology Group Inc. (KULR) also made headlines after announcing it had purchased another $13 million in Bitcoin, raising its total holdings to 920 BTC at an average price of $98,760 per coin. Its stocks responded positively, climbing 4.2% on the day. The post Crypto Stocks Climb as Public Companies Accelerate Bitcoin Accumulation appeared first on TheCoinrise.com .