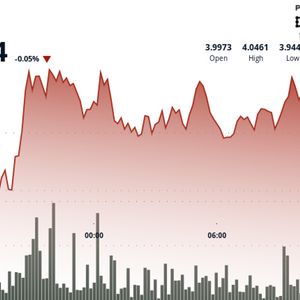

Despite Bitcoin’s recent climb above $110,000, altcoins remain stuck in a bearish rut, raising doubts about whether the long-awaited “altcoin season” will materialize anytime soon. According to a June 18 analysis by CryptoQuant contributor Burrakesmeci, one metric tells a compelling story. The 1 – Year Cumulative Buy/Sell Quote Volume Difference for Altcoins, excluding Bitcoin ( BTC ) and Ethereum ( ETH ), now sits at –$36 billion. This level that suggests investors are still pulling money from the altcoin market. The net demand from traders putting buy versus sell quotes on altcoin pairs across exchanges is reflected in this metric. It often indicates peak interest and occasionally a local top when it flips positive, as it did in December 2024. The trend has since reversed, with sustained outflows rather than inflows, as confirmed by the current reading which is in extremely negative territory. In short, altcoin investors are still sitting on the sidelines, even as Bitcoin dominates headlines. You might also like: Altcoin season is over: Here’s what can make a project thrive | Opinion This is important since the altseason usually has a set rhythm. Early bull cycles see Bitcoin at the top, particularly after halving, as was the case in April 2024. This attracts capital. Investors frequently shift their gains into altcoins when Bitcoin cools and starts to consolidate. Large-cap rallies like Ethereum are fueled by this rotation, which is followed by sector-specific spikes in memecoins, AI tokens, and other narratives. However, conditions do not currently favor that change. The Altcoin Season Index is stuck below 30, far below the 75 threshold. Bitcoin dominance is still high at 64%, and risk appetite outside of BTC and ETH seems to be muted. Although the ETH/BTC ratio is rising, currently at 0.02405, and Ethereum has recently outperformed Bitcoin on a 90-day basis, these signals are preliminary and not conclusive. Macro conditions may also be delaying the altseason. The amount of capital available for speculative assets like altcoins is limited by continuous quantitative tightening and persistently high interest rates. If rate cuts occur or Bitcoin’s dominance wanes, some analysts predict a shift in late 2025. Others caution that the wait may last until 2026 if there is no clear Ethereum breakout or regulatory clarity. The signal is clear for the time being. The road to altcoin season is still blocked in the absence of a reversal in volume flows, and it is difficult to overlook the $36 billion in lost demand. Read more: Trump says he won’t fire Fed Chair Powell, but urges faster rate cuts