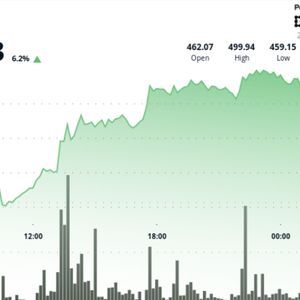

Bitcoin Cash surged to a two-month high above $499 as bulls took control during an aggressive rally fueled by institutional demand and broader market uncertainty. The move puts BCH within striking distance of the psychologically critical $500 level — a zone last touched during April's breakout attempt. News Background BCH’s rally comes as escalating global trade tensions drive demand for non-sovereign assets. The U.S. and China are once again ramping up tariff pressure, targeting high-tech sectors and stoking concerns over global supply chains. Risk assets have responded unevenly, but Bitcoin Cash has clearly benefited from capital rotation into mid-cap majors. The Federal Reserve’s stance remains firmly hawkish, with policymakers holding rates at 4.25%-4.50% and signaling further quantitative tightening. Bitcoin Cash, despite a history of volatility and fading retail hype, has recently shown signs of institutional reappraisal. Analysts point to its scaling simplicity, fast settlement times, and long-term technical base above $400 as factors drawing renewed interest. If momentum persists, BCH could attempt to flip $500 into a long-term support — a move that could change its macro structure heading into Q3. Price Action BCH rallied from $461.87 to a high of $492.08 over 24 hours, backed by strong inflows. The breakout began in earnest during the 13:00–14:00 window, when volume spiked to 152,140 units — more than five times the hourly average — confirming institutional buying. The price rejected off the $500 barrier multiple times, slipping to $490.46 during the early morning session before stabilizing. A brief sell-off at 04:51 triggered a quick dip to $491.47, but price soon reclaimed $485, showing signs of resilience and consolidation just below key resistance. Technical Analysis Recap Bitcoin Cash posted a 6.5% gain over 24 hours, rising from $461.87 to $492.08. Breakout confirmed by 5x volume surge (152K+) during the 13:00–14:00 hour. Price cleared long-term trendline resistance near $472 and held above the 100-hour SMA. Multiple tests of the $500 barrier suggest psychological resistance remains intact. Support formed at $490.46; consolidation zone now between $485–$492. RSI rising with room to run; MACD crossing into bullish territory. Bulls may target $505 or $520 next if $500 is convincingly broken. Disclaimer: Portions of this article were generated with the assistance of AI tools and reviewed by CoinDesk’s editorial team for accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.