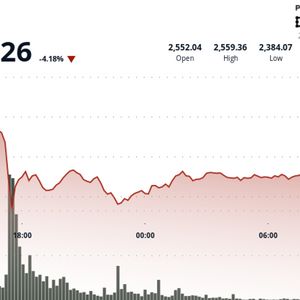

Ether (ETH) ETH posted a modest recovery on Saturday after a volatile week marked by outsized institutional outflows. On Friday, June 20, spot ETH ETFs listed in the U.S. recorded $11.3 million in net outflows — the largest single-day decline in June, according to data from Farside Investors . The pullback was led by BlackRock’s ETHA ETF, which saw a $19.7 million outflow — its first and only negative flow this month. In contrast, Grayscale’s ETHE product attracted $6.6 million, and VanEck’s ETHV ETF added $1.8 million, partially offsetting losses. No other issuers recorded inflows or outflows. The data suggests large institutions may be reducing their ETH exposure, even as select funds like Grayscale continue to attract capital. The ETF flow figures emerged alongside a technical rebound in price. Ether briefly dipped to $2,372.85 on Friday in a heavy sell-off marked by a volume spike nearly five times the daily average, but swiftly recovered as buyers stepped in around the $2,420–$2,430 range, according to CoinDesk Research's technical analysis model. This area has since formed a solid support zone, validated by multiple low-volume tests suggesting accumulation. The 24-hour trading volume surged 18.97% above the 7-day moving average, reflecting elevated trading interest during the price recovery. ETH closed near $2,445 and formed an ascending trendline of higher lows, though key resistance remains at the $2,480–$2,500 level. Technical Analysis Highlights ETH-USD posted a 24-hour trading range of $186.44 (7.25%), with a steep sell-off to $2,372.85 marking the session low. The drop occurred during the 17:00 hour and was accompanied by a sharp spike in trading volume, reaching 993,622 units—nearly 5x the daily average. A key support zone formed between $2,420 and $2,430, reinforced by multiple successful retests with progressively lower sell-side volume. ETH reclaimed 38.2% of the Fibonacci retracement from the sell-off and built an ascending trendline supported by higher lows. During the 08:00–09:00 hour, volume accelerated again, signaling bullish momentum and lifting price toward the $2,445 level. In the final hour, ETH traded within a narrow $5.83 band, ranging from $2,440.14 to a close of $2,443.45. A late-session rally peaked at $2,447.02 (11:38), with an intra-candle volume burst of 4,532 units. The price then dipped slightly but found immediate support at $2,439.38, continuing to respect the ascending short-term trendline. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .