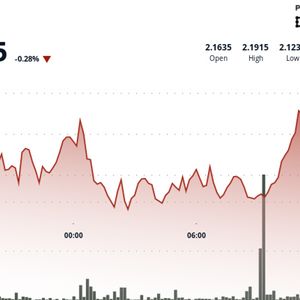

The cryptocurrency market is showing promising signs of a major upturn. Exciting opportunities are emerging that could lead to substantial gains. This article dives into which digital currencies are poised for significant growth. Discover which coins might offer a fresh chance at transformative profits. The potential for remarkable investment returns is on the horizon. Ethereum Market Outlook: Past Trends and Current Trading Zones Ethereum showed modest gains over the past week and month with increases of 2.39% and 3.28% respectively, while over the last six months, its price dropped by 24.22%. The coin moved within a trading range between $2111 and $2870.69, demonstrating short-term strength but failing to reverse the longer-term downtrend. Technical indicators, including a moderate RSI of 54.57, suggest limited recovery attempts. Price behavior during this interval reveals a struggle between brief bullish spurts and a prevailing caution due to previous losses, indicated by overall percentage decline. Historical data shows sporadic upward movement unable to offset sustained pressure over extended periods. Current trading sees Ethereum operating within a defined resistance and support range. The price fluctuates between $2111 at support and $2870.69 at the upper limit, with immediate resistance near $3254.47 and secondary resistance at $4014. Support strengthens at $1735.41, with an additional cautionary level near $975.87. Bulls have enough strength to push prices upward, but bears still influence the market due to the long-term downtrend. Trading ideas involve watching for a breakout above $3254.47 as a bullish sign and potential rebounds at $1735.41 for short-term entries. A cautious approach between these levels, along with risk management around resistance and support zones, can help traders capitalize on market movements. Solana Price Analysis: Volatility Today, Future Potential Tomorrow Solana past performance shows a modest rebound within the month with a 2.98% gain, while over the past six months prices fell by 24.61%. Weekly data hints at minor corrections with a 0.65% decline during the last week. Price fluctuations reveal that short-term recoveries have not been sustained, indicating trader caution amid shifting market conditions. Recent swings suggest that while small gains are feasible, the longer trend has been downward, reflecting a period of readjustment and volatility. The current trading range sits between approximately $131 and $173, with immediate resistance around $191.77 and a secondary barrier at $233.73. On the downside, support appears near $107.88, with a deeper cushion around $65.93 offering entry points for buyers. Technical indicators show a positive Awesome Oscillator at 1.63, a Momentum reading of 10.20, and a neutral RSI of 52.63. Bulls are testing resistance levels, while bears push back near support. Trading ideas include watching for a break above $191.77 for bullish confirmation or accumulating near $107.88 for potential rebounds. Cardano Price Dynamics: Cautious Setup Amid Bearish Trends Last month, Cardano dropped by about 10.52%, although a modest one-week gain of 1.56% provided a brief moment of strength. Over the past six months, the coin experienced a substantial decline of 40.59%, revealing a prolonged period of bearish pressure. Price activity during these periods shows a general downward trend, with investors remaining hesitant despite occasional signs of recovery. Currently, Cardano trades within a range of $0.48 to $0.70, facing resistance near $0.83 and support at $0.38. A push above $0.83 could lead traders to target around $1.05, while a dip below $0.38 may trigger stronger selling. Technical indicators reveal mixed signals: the Awesome Oscillator is slightly negative at -0.025, while the Momentum Indicator shows a mild uptick at 0.028. RSI close to 46.92 indicates neutral conditions without a clear trend. The market favors bears, suggesting traders might consider short-term entries near support with tight stop-loss measures to manage risk. Conclusion ETH , SOL , and ADA are showing promising signs. These coins have seen substantial development and growing adoption. ETH continues to be a strong player with its advancements. SOL impresses with high-speed transactions and efficiency. ADA focuses on innovative solutions. The market's current signals make it a favorable time to consider these cryptocurrencies. Such opportunities could lead to significant gains. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.