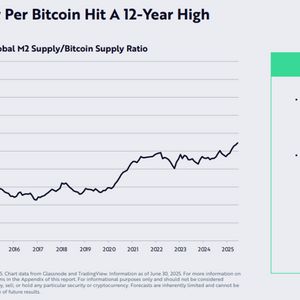

Tether Holdings SA, the issuer of the world's largest stablecoin USDT, is stockpiling around 80 tons of gold (worth $8 billion) in a secret vault in Switzerland. According to the information provided by the company's CEO, Paolo Ardoino, this vault belongs entirely to Tether and is described as “the most secure vault in the world.” However, for security reasons, the exact location of the vault and when it was established were not disclosed. Tether, a cryptocurrency company based in El Salvador, generates income by investing the dollars it collects in return for issuing USDT tokens. These investments include assets such as US Treasury bonds as well as precious metals. According to the company’s latest report published in March, precious metals make up about 5% of its reserves. Tether’s gold reserves are almost as large as the precious metal held by some major banks, such as Switzerland-based UBS Group AG, making it one of the largest holders of gold outside of a bank or government. But the rapid growth of stablecoins continues to be a concern for regulators and law enforcement. Tether has previously been criticized for the adequacy of its reserves. Rules enacted last year in the European Union and proposed regulations in the U.S. require stablecoins to be backed only by “cash-like” assets such as cash or short-term government bonds. If such regulations are enacted, Tether could be required to divest the gold it holds to back USDT. Related News: BREAKING: Elon Musk Does It Again - Surprise Altcoin Price Soars In addition to USDT, Tether also issues a gold-backed token, XAUT. Each XAUT token is backed one-to-one by one ounce of gold physically stored in Switzerland. The company has issued approximately $819 million worth of XAUT tokens to date, equivalent to 7.7 tons of gold. However, this figure is dwarfed by the 950 tons of gold held by major exchange-traded funds (ETFs). CEO Ardoino said, “Gold should be a safer asset than any national currency,” adding that the rising US debt level could drive investors to alternative assets. He also drew attention to the aggressive gold purchases of central banks in BRICS countries. *This is not investment advice. Continue Reading: The Country Where Tether (USDT) Is Keeping Tons of Its Gold Has Been Revealed – Here Are the Details